Corporations and Partnerships with Respect to Ribbit

From Halachipedia

Partnership of Jews and non-Jews

- It is forbidden to charge or take interest from an individual Jew or group of Jews. Some poskim allow borrowing or lending on interest to a partnership of Jews and non-Jews if the non-Jews comprise at least half of the group to which one is lending or from which one is borrowing.[1]

Partnership between Jews

Jewish Partners Borrowing from the Bank

- It is forbidden for several Jews, two or more, to borrow from a bank or non-Jew with interest such that the non-Jew can collect from any one of them. The reason is that if one of them pays then the others are obligated to repay the one who paid the interest. Thereby the one who paid would be like he lent everyone else with interest and is being repaid with interest.[2] Solutions include: specifying that if one of them pays on behalf of everyone that everyone will repay the one who paid the capital and not interest and the one who paid the bank or non-Jew will lose out on the interest. Another solution is to specify with the bank or non-Jew that every borrower is only obligated up to a specific amount and there's no obligation of one borrower for another.[3]

- If a Jew borrows on behalf of a Jewish partner or Jewish company from a bank or non-Jew with interest and then uses the partner or company's money to repay the loan that is considered interest. This is forbidden since the one signing is considered to have borrowed with interest and when he invests that money with the partner or company he is further lending it to another Jew with interest.[4] However, it is permitted if they originally borrowed in the name of all the partners or the entire company (aside from the other issue of the previous halacha, that one borrower can't be responsible for the entire loan).[5]

- If a Jew borrows on behalf of a Jewish partner or Jewish company for a bank or non-Jew with interest as an investment to the partnership or company and he is working in the partnership or company some poskim are lenient.[6] The halacha is that it is permitted to pay off the interest from the profits that were made with the money that was invested but they should not be taken from the partnership or company if the interest is greater than the profits made from that money.[7]

Preferred Payment and Non-Working Partners

- If Jews go into a partnership and both invest in the business, according to Ashkenazim, the business can pay out its investors in any payment structure it likes since it is a partnership and not a investment by one party with another party. According to Sephardim many say that this is an iska and unless the laws of iska are followed it is interest.[8]

- According to those who are lenient, it is acceptable even if the partnership is unequal partnership and certain partners invested more than the others.[9]

- According to those who are lenient to consider a partnership unlike an iska, some say that it is nonetheless forbidden for a working partner to accept more of the responsibility of losses and offer the other partners a greater share of the gains. Some are lenient on this.[10] Some say that it can be permitted if one gives an iska wage to the working partner, which could even be a dinar, as described below (#Wages_for_an_Iska_Worker).[11]

- According to those who are lenient to consider a partnership unlike an iska, some say that it is nonetheless forbidden for a working partner to offer another partner a fixed profit. Some are lenient on this.[12]

Partners in an Iska Arrangement

- Two Jews who work together as agents for an iska investment from an investor are bound to their partnership for the duration of the iska. One may not opt to split up the iska or the profits of the iska prematurely.[13] If they didn't specify a time see Shulchan Aruch C.M. 176:14.[14]

Corporations

- Some poskim say that it is permitted to lend or borrow on interest from a corporation even if it is owned by Jews because halacha views the corporation as a dummy entity that isn’t Jewish. Others say that it is only permitted to lend on interest from the corporation but not borrow on interest from them, while others still forbid both borrowing and lending with interest from a Jewish corporation.[15]

Non-Profits

- Money that belongs to orphans who aren’t bar or bat mitzvahed can be lent with rabbinic interest[16] but not biblical interest.[17] This is the practice.[18]

- The is permitted to collect the rabbinic interest even if it is collected after he is bar or bat mitzvahed as long as it was arranged beforehand.[19]

- If the orphan’s money was indeed lent with biblical interest, if the borrower invested and in fact made as much as the percent interest that was demanded he needs to pay it.[20] Some say that he only needs to pay it if he made twice as much as was demanded.[21]

- Money that is designated for talmud torah, poor people, or a shul can be lent with rabbinic interest.[22]

- Some say that it is permitted to lend money with rabbinic interest in order to have money to spend on a Shabbat meal or Suedat mitzvah.[23]

- This leniency does not apply to money designated for a tzedaka unless it was given to a charity and is in the domain of the charity.[24]

- Charity that is designated for an individual poor person can be lent with rabbinic interest.[25]

- Can you lend money with rabbinic interest to spend that money for a mitzvah? Some poskim hold that it is forbidden,[26] while others hold it is permitted.[27]

- If a power of attorney or agent lent money of orphans with interest on their behalf and they already took that money the power of attorney or agent doesn’t need to pay it back and the orphans as well can keep it.[28]

Iska

Definitions

- It is forbidden to give someone money to invest with an equal or greater amount of potential for the owner to gain than the worker because doing so is interest. The deal is considered to have more potential for the owner to gain than lose (karov lsachar vrachok mhefsed). The only reason that the worker would accept such a deal is because the owner is extending him a loan through which the worker can gain.[29]

- If someone gives his worker money and says that half is considered a loan and half an investment that is considered an iska and is forbidden without any other solutions. The half loan can be used by the worker for his own investment but it is completely his responsibility to repay the capital. The half investment is not to be used by the worker for his personal needs, is in the domain of the borrower, and whatever it gains or loses goes to the owner. This is a classic iska, which literally means investment.[30]

- For example, if a person gives the worker $100 for an iska. The worker invests all of the money and makes $10 profit. In a classic iska, the worker and owner would split the profits and the worker would return $105. Let's say that the worker invested and lost $10. In the iska arrangement, the worker and owner would again split the losses and the worker would return $95. This arrangement is forbidden without any other solutions.[31]

- The iska document must clearly state that it is an investment with part loan and part investment and not simply that it is a loan document or the like. Additionally, even if one is using a fixed cap for the profits that the agent needs to give the investor it is nonetheless forbidden to write that the agent owes that amount from the outset because it could be that he will not make those profits.[32]

How to Permit an Iska

- This can be remedied by either making it a favorable deal for the worker or by paying him. To make the deal favorable for the worker that would mean making it such that there is a greater percentage of gains that the worker makes than the percent of losses he assumes.[33]

- In the above example, if the worker was given a stipulation under which he would keep 2/3 of the gains and only assumed 1/2 of the losses, then it would be permitted. So, when he gained $10 he would return $103.3 and when he would lose $10 he would return $95. Alternatively, they could have arranged that the worker would keep 1/2 of the gains and only assume 1/3 of the losses. For our example, when the worker would gain $10 he would have to return $105 but in the case of a $10 he would return $93.3.[34] We hold that this arrangement is effective with any percentages as long as the amount that the worker stands to gain is greater than the amount he stands to lose.[35]

Wages for an Iska Worker

Fixed Wages

- If they stipulate in advance it is sufficient to pay the iska agent a small wage.[36] Some hold that any amount above a pruta is sufficient, while others hold that it is a dinar, which is closer to $3.[37] Some say that it must be an amount that is recognizably a wage and not a token payment.[38] The common practice is to give $1.[39]

- The wages are first taken from the profits and then the rest is split according to their stipulation such as splitting it evenly. If there are no profits the wages are first taken from the capital and then considering that there is now insufficient funds to return the capital it is considered a loss. Therefore, the terms and conditions for losses and the percentages that they stipulated to accept for losses apply to the amount of the wages.[40]

Paid by Commission

- As long as they stipulate at the beginning of the arrangement it is permitted to give the agent any percent of profits that is greater than the percent of losses he assumes. That difference in percentages is his wages as long as he agrees.[41]

- If one stipulates that the agent only needs to give a certain amount of profits to the investor and all other profits are waived and given to the agent this can be considered wages for the agent.[42] However, it must be stipulated that these are wages for his work and not simply that the investor waives his rights to them.[43]

- If they stipulate that the agent can keep the greater percent of gains than he accepts of the losses and it turns out that there are no gains then he doesn't receive any wage. It isn't considered interest since his wage was the opportunity he had to make money had he made gains.[44]

Other Benefits

- Some say that if there's a benefit that the agent has in fact that because he has more money from the iska it isn't necessary to pay him. That is, an iska is essentially a part loan and part investment and the part that is a loan belongs to the agent. If the agent would not have been able to invest his loan loan without the extra money of the investment part, such as with half of the money he doesn't meet a certain type of investment vehicle threshold, then the fact that he has a complete iska with the investment part as well is considered his wages.[45] Most others disagree.[46]

When Wages are Not Specified

- If the investor didn't specify in advance the wage of the agent, the iska worker, he must pay him the minimum price a worker. In fact halacha defines this wage to be ascertained by asking a person how much would they take as a salary not to have to work at all. This price would vary depending on their job.[47]

- If the iska document only specifies half gains and losses and isn't clear whether the term half is modifying the gains and losses, in which case it is problematic since there is no wage being apportioned to the agent, or only one of the terms, which is permitted as follows.

- For a great person who we would never suspect of having arranged a halachically forbidden transaction we explain that the document means to modify either the gains or the losses.[48] If half modifies the gains then the investor must accept two thirds of the losses, and if the half modifies the losses, then the investor is entitled to a third of the gains. The decision of whether half modifies gains or losses depends on the language of the document. If the language is that the investor grants or gives the portion of the profits to the agent then it is his decision. However, if the language is that the agent will take his portion of the profits then it is up to the agent's decision.[49]

- For everyone else we assume that this document is forbidden and the investor may not collect any profits.[50] Some say that the investor can simply state that he is interested to pay for the minimum wage of the worker and then reap the profits of the iska.[51] Others argue that since the document implied a halachically forbidden iska it is forbidden to take profits and it is not correctable.[52] The exact halacha is unresolved.[53]

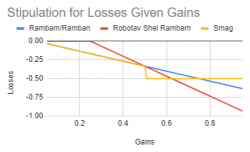

- If they stipulated the percent of gains that the agent would receive and not the losses, then we can calculate the stipulation for the agent to accept of the losses to be two thirds of the percent of the gains he was receiving. Conversely, if they stipulated the percent of losses the agent would accept and not the gains, then we calculate the percent gain of the agent to be the same amount as the percent losses he accepted plus a third of the percent of gains that the investor was receiving.[54]

Terms and Conditions of the Iska

If There Are Losses

- If the agent loses money he can swear to the fact that he lost money and split the loses.

- With the heter iska, it is stipulated that if the agent doesn't want to swear about his loses he can instead pay the agreed sum of money.

- It is permitted for the agent to pay and not to swear even if he knows that he lost money and didn’t make that amount.[55]

- If the investor knows that the agent certainly lost money then it is forbidden for the investor to claim that the agent should swear or pay him the agreed amount. Furthermore, he can't even accept any extra money even if the agent offers it.[56]

- Therefore, to avoid any issue the heter iska generally is written in a way that enables the investor to acquire a portion of all property and commodities of the agent then it is permitted since it generally true that the investor will be unaware of some business, property, or commodity of the agent. In such a case it will be nonetheless permitted to have the agent either swear that he didn't gain or pay the stipulated amount. If even with this stipulation the investor knows that the borrower didn't make the profits discussed by the transaction in any of his businesses, properties, or commodities then he may not pay the stipulated amount.[57]

- Payment for income taxes on the investment are considered a loss of the iska.[58]

Obligation of the Agent to Watch the Money

- The agent investing the money on behalf of the investor is considered a paid watchman (shomer) since he is being paid for his work.[59]

Obligation of the Agent to Invest the Money

- The agent should only invest in whatever was agreed upon in the iska agreement.[60]

- If the agent didn't fulfill his obligation to invest the money the investor can justifiably be upset with the agent but nonetheless, the agent is exempt from paying the investor anything more than his capital.[61]

- If the agent is paid to spend all of his time working on investing the money then he isn't allowed to invest for himself on the side. If he does and profits, those profits belong to the investor.[62]

- The agent must invest all of the funds and even though half or a portion is considered a loan that doesn't mean that the agent can use it for his personal expenses. Furthermore, he may not even leave the money in a security deposit instead of investing it.[63]

- The agent may not invest the investor's portion of the money in one investment and his portion of the money in another investment; rather he should invest everything in the same investment(s).[64]

If the Agent Breaks the Stipulations

- It is permitted to create whatever conditions the investor would like upon the agent and if the agent doesn't follow those conditions then the agent takes responsibility for all of the losses and the gains continue to be split as before. Indeed it is permitted for the agent to not follow these conditions.[65] It isn't considered more beneficial to the investor (karov lsachar vrachok mhefsed) since he can only gain and not lose because the original made it possible that it would been a regular iska.[66]

- If the agent explicitly states that he is stealing the funds for himself,[67] then all the loses and gains accrue to the agent and not the investor. To avoid this it is advisable to stipulate that if the agent steals the money for himself then he must repay it to the investment. Thereby all profits will continue to accrue to the investor. If the practice is allow the agent to take money for himself and repay it then it isn't necessary to make such a stipulation explicit.[68]

- If the agent is buying a certain investment for the iska, he can add his own private funds to buy the same commodity for himself as well. The agent must be careful that his adding his own private funds has no chance of hurting the investment of the investor. The same is true of selling.[69]

If They Want to End It Prematurely

- The investor may not dissolve the iska prematurely.[70]

- The agent should not break his part of the contract prematurely and doing so is considered dishonest,[71] however, if he wants to he can.[72] If he so chooses, he is obligated to repay the invest his capital and any portion of gains or losses that accrued to his investment according to the stipulation.[73]

- If as a result of the agent backing out of the iska arrangement there is a tangential loss to the investor, besides the loss that is a result of the investment, the agent may not back out.[74]

- The agent may not quit the iska arrangement because he is interested in getting paid a higher salary.[75]

- The above rules apply to the modern heter iska as well.[76]

Alterations to Transaction before Maturation

A Loan that was Converted into an Iska

- If a person made a loan and then in the middle of the duration of the loan wanted to change it into an iska, they can do so provided that they establish a valid mechanism of acquisition that would make the agreement legally binding. Many hold that it is sufficient to do a kinyan sudar or write a document that converts the loan into an iska. Others require that the lender acquire the capital to be returned or the commodity that the borrower will buy as part of the iska.[77]

- If someone didn't convert the loan into an iska effective and instead only orally agreed upon it, then it is essentially still a loan. The borrower even in the event that he profits does not have to split those profits with the investor.[78] If the borrower invested and profited there is a discussion if it is allowed for him to voluntarily give some of the profits to the investor.[79]

An Iska Agreement that was Converted into a Loan

- An iska agreement that was renegotiated to be a loan with interest obviously is forbidden.[80] However, if the event that the agent continues to invest the money and indeed made the profits that were stipulated by the original iska, after the fact it can be considered as though they continued a permitted iska and the money doesn't need to be returned.[81]

- In this case if the investor claims that the agent made more profits he can't force the agent to swear.[82]

- If the agent claims that the money he already paid to the investor was interest and it should be returned, the investor is believed without swearing to say that he accepted it as iska payments because such payment were due to him according to the original iska as there were indeed specified profits and it was not interest.[83]

- It is possible to change an iska into an interest free loan with a verbal agreement of the two parties without any other formal methods of acquisition.[84]

Rolling Over a Iska Upon its Maturity

- Many poskim hold that upon maturity date of the iska if the investor and agent don't stipulate what to do or actually return the money, it is considered to be assumed that the same iska setup will continue. In other words, the first iska rolls over into another iska unless otherwise stipulated.[85]

- If an iska matured and there were profits unless the agent specifies with the investor about those profits that a part belongs to him and only the money that is disbursed to the investor rolls over to the next iska, it continues to be treated as one iska with splitting all the profits according to the original stipulation.[86]

- If an iska matured[87] and there were losses and the agent didn't tell the investor and left the arrangement in place to roll over to a new iska, halacha views it as one long iska. Therefore, if there were losses in the first term and then gains in the second term, they aren't judged independently according to the gains and losses conditions, rather the losses are deducted from the gains and then the net result is judged by the gains and losses conditions.[88] The same is true of the opposite case where he gained in the first term and lost in the second term that we judge only net gains or losses.[89]

- If the agent stipulated that the profits or losses from the first term are going to be judged independent of the second term they follow that stipulation.[90]

Disputes Between Investor and Agent

- The agent claimed that there were profits and gave distributions or dividends to the investor based on those claimed profits. Then after the duration of the investment the agent claims that it was fraud and in fact he did not profit and should only return the capital after deducting the distributions or dividends he made. The halacha is that he is not believed and the investor is entitled to his entire capital since it was given as a profit.[91]

Rights of the Investor to His Profits

- The agent who has the portion of the profits from the investment on the behalf of the investor may not spend 10% as maaser on a tzedaka of his choice. Doing so isn't his right. Rather he should give the portion of the profits to the investor and he should give the appropriate tzedaka he wishes.[92]

- The investor is entitled to his profits before any creditor of the agent can collect them. This is provided that there is a clear proof with witnesses as to the whereabouts of the investment.[93]

- If the agent wrongly gifted the profits of the investment to other people the agent is obligated to pay the investor and if he can't then the receipts of the gifts are obligated to pay the money back to the investor since it is his investment and his profits. (This type of scenario is possible in a Ponzi scheme.)[94]

Multiple Iska Arrangements

- If someone does multiple iska arrangements with another person and each one has a separate document then they judged separately for purposes of calculating gains and losses. If multiple investments over time are included in one document they are all judged as one iska arrangement.[95]

Alternate Versions of Iska

Capping Profits

- If an iska is otherwise set up correctly with half of it a loan and half investment and there's a wage paid to the agent, then it is permissible to fix a cap of return profit that the agent would have to give and if he made more he can keep it.[96]

- It is permitted to arrange that if the agent makes any profit he needs to pay a certain fixed amount to the investor, if the agent doesn't make profit he is exempt, and if he loses then the agent and the investor split the loses.[97]

All Profits to Agent

- It is impermissible to have all of the profits of the investment to accrue to the agent for a fixed fee that the agent pays the investor. Doing so is finding a loophole in the laws of interest and forbidden.[98]

- It is forbidden to stipulate that the gains and losses accrue to the agent and the agent owes a fixed amount to the investor. This is considered taking interest even if the investor accepts the responsibility for if it is lost, stolen, or an unexpected circumstance.[99]

All Profits to Investor

- It is permitted for the investor to make all of the profits of an iska if he pays for the wages and additionally pays the agent an extra fixed income to offset the profits he is acquiring from the agent. It is permitted since there is an element of risk as the investor doesn't know how much profit will be made if at all.[100]

- If someone is doing an investment[101] entirely for the benefit of the investor and doesn't take any profits from the investments or has other benefits, he is considered an agent of the investor and not a borrower. In such a case it is permitted even for the agent to accept responsibility for the investment that if it depreciates that he will nonetheless return the capital since he is merely a guard with a lot of responsibility and not a borrower.[102]

Iska for Commodities

- If someone takes a job to improve and sell the merchandise or livestock of someone else and he accepts all responsibility of its losses and also agrees to pay its original price if it is destroyed or dies that is forbidden as interest. Even though the worker gains from a percent of the profits of the merchandise or livestock the deal is considered to have more potential for the owner to gain than lose (karov lsachar vrachok mhefsed). The only reason that the worker would accept such a deal is because the owner is extending him a loan, the commodity, through which the worker can gain.[103]

Sources

- ↑ The Shoel U'Meshiv (Mahudra Kama 3:31) writes to Rav Shlomo Ganzfried, author of the Kitzur Shulchan Aruch, that he held that it was permitted to borrow or lend with interest from a partnership between Jews and non-Jews. He thought that since the partnership signs under the title of an entity and not individuals it is permitted according to Rashi and those who hold that lending on interest through a messenger is permitted. Further, even according to those who argue with Rashi, he thought that it was permitted if there are non-Jews in the group so that the Jews can say that they only profited from the non-Jewish borrowers and not the Jewish borrowers. Rav Yitzchak Schmelkes in Beis Yitzchak (v. 2 Kuntres Acharon no. 32) qualifies the Shoel V’nishal’s permit to cases where there are a majority or at least half non-Jews. Mishneh Halachot 6:145 and 13:130 permits borrowing or lending from banks that have a minority of Jewish shareholders because the Jewish shareholders don’t have a say in how the bank runs. The Maharam Shik YD 158 argues with the Shoel V’nishal’s logic; see there for his leniency with other conditions.

- ↑ Chavot Daat 170:1, Chelkat Binyamin 170:25 based on Graz 64 and Chavot Daat

- ↑ Chelkat Binyamin 170:25

- ↑ Taz 170:3

- ↑ Chelkat Binyamin 170:25

- ↑ Taz 170:3 is lenient. Chavot Daat 170:1 is strict unless the other partner is unaware of the fact that the partner borrowed with interest. Also Chavot Daat is only lenient to pay the interest with the profits.

- ↑ Chelkat Binyamin 170:25 based on Graz

- ↑ Rama 177:3, Shach 177:13.

- Rambam Sheluchin Vshutfin 6:1 includes the laws of a Jewish partnership with the laws of an iska. Therefore, in order for a partnership to pay its partners permissibly and avoid interest they would need to follow all of the laws of iska. However, the Smag 82 and Rif (Shaarim Shevuot 8) argue that a partnership is fundamentally different than an iska investment. In an iska there is one investor and one agent and since the agent is also profiting it is considered part loan. If the agent is working on behalf of the investor to invest the money then it is problematic as that work is being done in compensation of the loan granted to him by the investor, thereby being considered interest. On the other hand, a partnership is where each party invests their own money and the business uses that capital. Since there was no loan, it is permissible for the partnership to pay its partners in any fashion. The Gemara Bava Metsia 69a seems to address this situation but can be read by all rishonim. See Bet Yosef 177:3 and Kesef Mishna on Rambam Sheluchin 2 s.v. vim for discussion. Milveh Hashem cites the Rabbenu Yerucham (Netiv 8) on the side of the Rambam and Ritva b"m 69a on the side of the Rif.

- Rama 177:3 and Shach 177:13 rule like the Smag and Rif. Chelkat Binyamin 177:56 agrees for Ashkenazim. For Sephardim, Milveh Hashem 2:12:26 rules like the Rambam. He cites the Maharbach 38, Maharikash on Shulchan Aruch 177:5, Chida in Shiurei Bracha YD 177:2, and Maharam Galanti 98 who all rule like the Rambam for Sephardim. Shulchan Aruch 177:24 follows the Rambam regarding a partnership as the Chelkat Binyamin 177:206 points out. Nonetheless, Horah Brurah 177:35 is lenient even for Sephardim.

- ↑ Chelkat Binyamin 177:56 based on Chachmat Adam

- ↑ Chelkat Binyamin 177:57 writes that Chavot Daat forbids while the Shach 177:13 permits. Torat Ribbit 27:3 writes that everyone forbids having a working partner offer the larger investor a greater return than the percent of losses he accepts. He references Radvaz 1:247 Maharashdam YD 61, Tashbetz 2:267, and Darkei Teshuva 177:20 as being strict and Maharam Galanti 98, Maharsham 7:140, Bet Dovid 87, Maharitatz 117, and Minchat Shlomo 1:28 as being more lenient.

- ↑ Milveh Hashem 2:12:27 based on writes that if the worker partner gives the other investing partner a greater share of the profits then it is considered an iska that needs to be fixed by paying the partner for his work and even a dinar suffices. He writes that he is based on Shiurei Bracha YD 177:2 and Shulchano Shel Avraham 177:9. However, Chelkat Binyamin 177:57 argues that if it isn't equally apportioned it is forbidden according to the Chavot Daat and it can't be fixed by paying a dinar as it is completely karov lsachar vrachok mhefsed.

- ↑ Chelkat Binyamin 177:58 writes that it is possibly worse than the dispute above and nonetheless the Torat Ribbit 27:4 thinks it is comparable.

- ↑ Gemara Bava Metsia 105a, Tur and Shulchan Aruch Y.D. 177:35

- ↑ Shach YD 177:62 cites the Bach who says that in absence of a stipulation they can break up the profits premature of the time that the local practice is to break it up.

- ↑ Igrot Moshe YD 2:63 thought that the prohibition of borrowing with interest does not apply to a corporation. Since no one person has personal liability for the loan, the corporation may pay interest. He based this contention on the opinion of Rabbenu Tam (cited by Tosfot Ketubot 85b) who says that there are two types of indebtedness: a lien on one’s property and a personal one. Rabbenu Tam holds that if a person forgives the borrower and relinquishes the personal lien even if there still is a property lien that was sold to another person, that property lien automatically falls apart. Accordingly, one may receive interest from a bank or invest in bonds or stocks of a corporation, though one still would not be allowed to borrow from a corporation.

Maharshag YD 3 brought a proof that there is no biblical ribbit to charge a corporation interest from the Gemara Gittin 30a that permits giving money in advance to a kohen so that the next time a person has a crop he can take off Trumah, sell it to kohanim, and then the proceeds are effectively given to the kohen and used to pay off part of the debt so that the owner can keep the proceeds of the sale. The gemara explains that even though there is a rabbinic prohibition of interest to pay in advance for food that hasn’t grown and there’s no market price, here it is permitted since the kohen borrower has no real obligation to pay out of pocket according to the original stipulations. The Chelkat Yakov YD 66 grapples with the Rogachover and Maharshag but ultimately says that it is forbidden rabbinically even though there is a good logic to permit it. Rav Zalman Nechemya Goldberg (Shiurei Ribbit p. 8) questioned the proof of the Maharshag because the risk factor that the debtors won’t pay the bank isn’t as great as the risk that a field gets ruined. Minchat Shlomo 1:28 argues with Rav Moshe and isn’t lenient in either direction. Lastly, Rav J. David Bleich in Netivot HaHalacha v. 2 p. 191-4 disagrees with Rav Moshe that it is impossible to have a shiybud nechasim without shiybud haguf. If there exists a shiybud it also applies to the guf even though there is some external conditions which make it impossible to collect from the shiybud haguf. - ↑ Gemara Bava Metsia 70a concludes that it is only permitted to lend money of orphans as interest if the interest is only rabbinic but not if it is biblical. This is accepted by the poskim and Shulchan Aruch Y.D. 160:18.

- ↑ Although it was clear from the Bavli Bava Metsia 70a it is forbidden to lend money of orphans with biblical interest, the Maharil responsa 73 cites a practice to do so and justifies it based on the Yerushalmi Sanhedrin 7. However, the Maharil concludes that the practice is completely invalid and should not be followed. The Rama 160:18 cites the maharil that this practice was completely rejected. Shach 160:27 adds that there’s no such practice any more as it was wrong. See Yabia Omer YD 5:13 who cites many rishonim who did explain that the yerushalmi held it was permitted.

- ↑ Even though the Shach 160:19 writes that the practice was not to lend orphan’s money with any interest even rabbinic interest, the Nodeh Byehuda YD 40 writes that the practice is completely justified based on the majority of rishonim and Shulchan Aruch. He testified that he did so personally. Pitchei Teshuva 160:20 cites the Nodeh Beyehuda. Chelkat Binyamin 160:200 agreed.

- ↑ Pitchei Teshuva 160:23 citign Mishna Lemelech

- ↑ Shulchan Aruch Y.D. 160:19. The Rashba responsa 2:174 writes that if the orphan’s money was lent with biblical interest it must be returned like any case of interest. However, the Maharil responsa 37 tries very hard to allow the orphans to keep it. The Maharam prague edition 969 has another justification.

- ↑ The Bet Yosef 160:19 writes that even according to the Mordechai 332 and Maharam’s leniency that we view the loan with interest as though it was an investment (iska) that is permitted it is at most viewed as an iska transaction. Therefore, since in an iska half of the profits go to the investor the orphans only deserve have of the profits made up to the amount of the percent that they demanded. However, the Mahara Sason 162 argues that the lender has to pay all of his profits to the orphans and not just half. The Shach 160:32, Chachmat Adam 130:10, and Chelkat Binyamin 160:215 cite this dispute and do not offer any resolution.

- ↑ Shulchan Aruch 160:18. The Rosh, Tur, Rabbenu Yerucham, and Rashba apply the leniency of lending orphan’s money with rabbinic interest to other cases of mitzvah such as talmud torah. The Shulchan Aruch codifies this opinion.

- ↑ Pitchei Teshuva 160:22 citing the Bear Yakov, Yalkut Yosef 253:4

- ↑ Chelkat Binyamin 160:195 based on Mishna Lmelech

- ↑ Chelkat Binyamin 160:196 quotes the Bet Yosef within the Rashba says that lending charity with rabbinic interest is only permitted if the money isn’t yet designated for one poor person. However, the achronim hold that it is permitted as long is it is designated for the poor and even an individual.

- ↑ Mishna Brurah (Shaar Hatziyun 242:15)

- ↑ Chazon Ovadia Shabbat v. 1 p. 9 writes that it is permitted to lend money with rabbinic interest in order to spend it for a Shabbat meal or seudat mitzvah. This is based on the Magen Avraham 242:2 who says that it is permitted to lend with interest in order to spend for a Shabbat meal.

- Yerushalmi Sanhedrin 8;2 establishes that it is permitted to lend with interest in order to have money for a meal of a mitzvah such to establish the kiddush hachodesh. Shibolei Haleket 55 applies this also to Shabbat meals. What type of interest is permitted for a mitzvah? Or Zaruah Tzedaka 30 explains that even biblical interest is permitted to further a mitzvah. Mordechai b”m 287 cites Rabbenu Shmuel who agrees. This opinion is cited in the Aguda b”m 4:73, Maharil 37, and Hagahot Maimoniyot (kushta edition, malveh 4). Mahara Ben Tauba cited in Tashbetz 34 agreed. However, this opinion is rejected by the overwhelming majority of poskim as is evidenced by Bet Yosef 160:18.

- Maharam (krimnoa edition 109) holds that it is forbidden to lend money for charity with biblical interest but it is permitted to lend them with rabbinic interest. This is also the opinion of the Rosh responsa 18:8, Rashba responsa 4:232, Shulchan Aruch 160:18, and Gra 160:43. Radvaz 6:2306 writes that everyone holds that rabbinic interest is permitted for charity.

- Magen Avraham 242:2 cites the Shibolei Haleket that it is permitted to lend with interest for a Shabbat meal. The Netiv Chaim explains that this means borrowing with interest from a non-Jew. However, Rav Ovadia (Chazon Ovadia Shabbat v. 1 p. 7) argues that there is no prohibition to borrow from a non-Jews with interest (Rambam Malveh 5:2). Shulchan Aruch Harav 242:9, Rav Shlomo Kluger in Chachmat Shlomo 242, Kinyan Torah 7:20, Bear Yakov 242 cited by Pitchei Teshuva 160:22, and Chazon Ovadia all hold that it is permitted to lend with rabbinic interest in order to get money for the meals of Shabbat. Shevet Halevi 2:64:1, 8:189 seems also to support this opinion.

- ↑ Shulchan Aruch 160:20

- ↑ Rashi b"m 68a s.v. ein, Shulchan Aruch Y.D. 177:2

- ↑ Shulchan Aruch Y.D. 177:2

- ↑ Shulchan Aruch Y.D. 177:2

- ↑ Gemara Bava Metsia 68a, Shulchan Aruch Y.D. 177:24. Taz 177:33 clarifies that after the fact in the first case that it was stated as a loan then it is completely forbidden to accept any profits since indeed it is considered a loan according to the written document and we don't follow their oral agreement. However, if the document is ambiguous as in the second case and it was only stated that the agent owes a certain amount and not as a result of a loan then although the document is problematic if there are profits the agent can give the portion due to the investor.

- ↑ Shulchan Aruch Y.D. 177:2-3

- ↑ Gemara Bava Metsia 68b-69a

- ↑ These stipulations are those of the Gemara Bava Metsia 68b as understood by the Raavad Sheluchin 6:3, Tur 177:4, Shach 177:14, Taz 177:8, and Chelkat Binyamin 177:70. This can be followed even if not stipulated in advance. However, once it is stipulated in advance it is sufficient to give the worker even a small increase (Shulchan Aruch 177:3, Chelkat Binyamin 177:162).

- ↑ Shulchan Aruch Y.D. 177:3

- ↑ Chelkat Binyamin 177:55 cits that the Birkei Yosef holds that a dinar is necessary while the Prisha, Bet Meir, and Chavot Daat think that it could be less than a dinar.

- ↑ Bet Yosef 177:2 citing Smag, Chelkat Binyamin 177:55 citing Darkei Teshuva from Bet Dovid

- ↑ Igrot Moshe 3:39, Chelkat Binyamin 177:55, Heter Iska of the Bet Din of America, Heter Iska of Star-K

- ↑ Shach 177:53, Shulchan Aruch Y.D. 177:28

- ↑ Rambam Sheluchin 6:4, Chelkat Binyamin 177:51. See Shulchan Aruch 177:3 and Shach 177:9 who also seem to agree. Rambam Sheluchin 6:4 quotes his teachers who thought that this leniency to stipulate that the worker receive a portion of the profits that is greater than the percent of losses he accepted is only effective as long as the agent has another investment that he is also dealing with for himself. Rambam himself disagrees. Chelkat Binyamin 177:3 s.v. bameh clarifies that the Gra holds that the Rif and Rosh are strict about this like the teachers of the Rambam. Nonetheless, the halacha is like the Rambam.

- Rambam Sheluchin VShutfin 6:2 only allows giving a larger portion of the profits if the investor has another job. However, in 6:4 he allows it even if he doesn’t have another job. The Bet Yosef YD 177:2 explains that 6:2 is discussing where they didn’t stipulate the price in advance, whereas 6:4 is discussing where they did stipulate in advance. Shulchan Aruch Y.D. 177:2 rules like the Rambam. Taz 177:5 disagrees with this approach and forbids giving an extra portion if they didn’t stipulate in advance. Shach 177:9 writes that majority of poskim disagree with the Rambam and would permit giving a larger portion of profits even if they didn’t stipulate in advance.

- ↑ Shach 177:9, Chelka Binyamin (Kuntres Heter Iska n. 8) based on Rambam Sheluchin Vshutfin 6:4. See also Shulchan Aruch Y.D. 177:3.

- ↑ Chelkat Binyamin 177:54 citing Chavot Daat

- ↑ Shulchan Aruch Y.D. 177:28

- ↑ Taz 177:9

- ↑ Chelkat Binyamin 177:28 based on Chavot Daat, Shaarei Deah, and Sherit Chaim

- ↑ Chelkat Binyamin 177:31 and Milvah Hashem 2:12:4 follow the opinion of Tosfot either because Shulchan Aruch didn't clarify and we can be lenient since it is only rabbinic or because it is the simplest explanation in the words of Shulchan Aruch and the Bet Yosef elaborated upon that opinion. Chavot Daat 177:3 also holds like that opinion.

- ↑ Gemara Bava Metsia 68b, Tur and Shulchan Aruch Y.D. 177:26

- ↑ Tur and Shulchan Aruch Y.D. 177:26. Gra 177:56 notes that the Rambam thinks that the iska agent always gets to choose as it seems from Shulchan Aruch Y.D. 177:4.

- ↑ Tur and Shulchan Aruch Y.D. 177:25

- ↑ Maharam Ibn Chaviv

- ↑ Hagahot Prisha. Shach 177:52 seems to quote the Hagahot Prisha as being strict, nonetheless his conclusion seems to be at odds with this. That is why the Maharam Ibn Chaviv indeed alters the text of the Shach to be lenient. Most achronim however quote the Shach as being strict including Chelkat Binyamin 177:218.

- ↑ Chelkat Binyamin 177:218 cites another dispute as to whether we should follow Shulchan Aruch at all. Shulchan Aruch 177:25 based on the teshuva of the Rosh states that if the document is stated in a forbidden manner one may not collect any profits. Nonetheless, Shulchan Aruch Y.D. 177:28 seems to contradict that. Therefore, the Maharaal 177:39 disputes Shulchan Aruch 177:25. Chelkat Binyamin leaves it as an unresolved halacha.

- ↑ Rambam Sheluchin 6:5, Shulchan Aruch Y.D. 177:27. The Rambam's calculation of losses can be calculated with the formula L=(-2/3)*G, where L is losses and G is gains, and calculation of gains by the formula G=L+(1/3)*(1+L). An elaboration on the math for each of the rishonim on this topic see this spreadsheet and the charts to the right.

- ↑ Milveh Hashem 2:12:20, Chachmat Adam 142:10, Chelkat Binyamin Kuntres Heter Iska n. 12

- ↑ Igrot Moshe 2:62-63 s.v. vtzarich, Chelkat Binyamin Kuntres Heter Iska n. 13 citing Teshurat Shay 23, Harei Besamim 2:!43,

- ↑ Chelkat Binyamin Kuntres Heter Iska n. 13

- ↑ Rama 177:34, Chelkat Binyamin 177:268

- ↑ Shulchan Aruch Y.D. 177:5

- ↑ Tosefta b"m 4:21 establishes that someone who takes an iska arrangement can buy any type of food or animal and not utensils or wood since they was the stipulation. Shulchan Aruch Y.D. 177:38 codifies this. Shach 177:66 explains that there is another possible reason to forbid an agent from investing in a type of investment and that is because it is a bad investment. Chelkat Binyamin 177:289 expands this halacha to include any stipulation they agreed to.

- ↑ Shulchan Aruch Y.D. 177:40

- ↑ Tosefta b"m 4:13, Shulchan Aruch Y.D. 177:29, Taz 177:44, Shach 177:67, Netivot Hamishpat CM 176:20, Chelkat Binyamin 177:234

- ↑ Shulchan Aruch Y.D. 177:30

- ↑ Tosefta b"m 4:19, Shulchan Aruch Y.D. 177:37

- ↑ Rama Y.D. 177:5. It isn't considered as though the agent stole the money since he is doing so for the benefit of the investor (Shulchan Aruch Y.D. 177:5, Taz 177:10). Ran teshuva 73 writes that if someone gives an agent money as an iska and the agent changes from the agreement, then if the agent losses the agent must pay the capital since the agent's changing from the stipulation allows the investor the ability to claim that he didn't administer such transactions. If he gains the agent must pay according to the stipulation of the iska.

- ↑ Shulchan Aruch Y.D. 177:5. Shach 177:17 clarifies that this is only permitted since an iska is only rabbinic interest to begin with.

- ↑ Taz 177:11 notes that it is only effective if the agent states that he is stealing it at the time that he used it for himself, however, afterwards he isn't trusted to say he stole it as opposed to merely used it for the benefit of the investor against the conditions of the investor. Although Nekudat Hakesef 177:5 disagrees the Bear Heitiv 177:12 points out that this Nekudat Kesef is very difficult to understand. Chelkat Binyamin 177:83 agrees with Taz.

- ↑ Rama Y.D. 177:5

- ↑ Tosefta b"m 4:21, Tur and Shulchan Aruch Y.D. 177:39, Taz 177:45, Shach 177:68

- ↑ Shulchan Aruch Y.D. 177:36

- ↑ Chelkat Binyamin 177:282 based on Shulchan Aruch C.M. 333:1

- ↑ Shulchan Aruch Y.D. 177:36

- ↑ Chelkat Binyamin 177:281

- ↑ Chelkat Binyamin 177:282 based on Shulchan Aruch C.M. 333:5

- ↑ Chelkat Binyamin 177:282 citing Rama C.M. 333:4

- ↑ Chelkat Binyamin 177:280

- ↑ Chelkat Binyamin 177:171 cites that the Dagul Mirvava on Shach 177:41 thinks that a kinyan sudar or shtar is sufficient to conver ta loan into an iska, and the Graz argues that only acquiring the money that is to be returned or the product that the borrower is buying is effective.

- ↑ Maharshal in Yam Shel Shlomo b"k 8:70 that if they merely orally agree to switch the loan into an iska it is unchanged and in the event of loss the investor doesn't lose. Shach 177:41 cites this.

- ↑ Maharshal in Yam Shel Shlomo b"k 8:70 indeed writes that even though the borrower isn't obligated to pay a portion of his profits to the lender since it is a loan, if he wishes to he may do so. The Shach 177:41 cites this. However, the Chavot Daat 177:19 disagrees since this is considered interest after the duration of the loan and forbidden. The Mekor Mayim Chayim 177:19 explains that the Maharshal thinks that the intent of the borrower is to treat it as a investment and so they can pay the profits since it isn't paid with intent for the time-value of money. Chelkat Binyamin 177:171 believes that this is effective even if the borrower and lender are aware that in fact it remained a loan. However, the Brit Yehuda ch. 35 fnt. 18 limits the Maharshal to where the borrower is unaware of the fact that the loan was not effectively changed into a iska. In any event, the Chelkat Binyamin is hesitant to rely upon the Maharshal and only relies upon him if it is after the time of the repayment of the capital and not at the same time as the repayment of capital.

- ↑ Taz 177:14 points out that whether this is biblical or rabbinic interest depends on the dispute in Shulchan Aruch 166:2.

- ↑ Shulchan Aruch 177:7

- ↑ Shach 177:23, Chelkat Binyamin 177:111. See there for the discussion of the possibility of making the agent swear with a cherem and also the Dagul Mirvava's claim that there would be an obligation to swear because of the joint partnership (see C.M. 93:4).

- ↑ Shach 177:23, Chelkat Binyamin 177:111

- ↑ Chelkat Binyamin 167:8, 177:171

- ↑ Taz 177:14, 177:31, Chelkat Binyamin 177:112. This is regarding a regular iska with part loan and part investment. In Chelkat Binyamin (Biurim s.v. muter p. 650) he quotes a dispute between the Imrei Esh 56 and Bet Yitzchak 2:7 whether a heter iska of the Maharam would rollover to another iska. However, that was specifically because the arrangement was such that there was a period of investment and then a period of loan and the dispute was whether it would automatically rollover to another deal with the same conditions.

- ↑ Nemukei Yosef b"m 40b s.v. tanya cites a dispute between Tosfot and the Rambam whether the iska converts into a part partnership and part iska or remains complete iska. He says that Tosfot thinks it automatically developments into a part partnership since the original profits are split and then the new iska is only within the dividend that the investor received. However, the Rambam Sheluchin ch. 8 thinks that it remains a complete iska unless the agent specifies or stipulates with a bet din otherwise. Shulchan Aruch 177:23 follows the Rambam.

- ↑ Chelkat Binyamin 177:261 based on Chazon Ish and Shitah Mikubeset Bava Metsia 105a. The Chelkat Binyamin explains that it doesn't matter if in middle of the investment term the agent were to return losses or gains only the net gain or loss is judged at the end of the term.

- ↑ Gemara Bava Metsia 105a, Shulchan Aruch Y.D. 177:34, Shach 177:61, Taz 177:40. The reason is that since the agent willing continued to invest the money and didn't tell the investor about the losses out of embarrassment he willing indebted his future profits to makeup for the losses of the first term of the iska.

- ↑ Chelkat Binyamin 177:262. Even though the reason of the gemara that the agent was embarrassed doesn't apply here, another reason applies; that is, the profits are "indebted" to the iska and therefore reinvested and not judged independently.

- ↑ Rama 177:34

- ↑ Shulchan Aruch C.M. 81:30, Y.D. 177:20

- ↑ Rama 177:22

- ↑ Shulchan Aruch Y.D. 177:31

- ↑ Shulchan Aruch Y.D. 177:32, Shach 177:60, Chelkat Binyamin 177:256. See there for more details.

- ↑ Gemara Bava Metsia 105a, Rambam Sheluchin Vshutfin 7:3, Tur and Shulchan Aruch Y.D. 177:33

- ↑ Taz 177:12

- ↑ Taz 177:12

- ↑ Taz 177:12 in explaining Shulchan Aruch 177:6, Chelkat Binyamin 177:91

- ↑ Chelkat Binyamin 177:91 based on Prisha and Bach in explaining Shulchan Aruch 177:6, Rama 177:6. Even though Shach 177:20 is lenient, Chelkat Binyamin 177:98 rules against him.

- ↑ Taz 177:12

- ↑ Chelkat Binyamin 177:19 writes that although the discussion of Rama 177:1 is about property it can also apply to money.

- ↑ Sh"t Ran 73 cites the Chachmei Lunil who said that if an investor has an agent invest his money and all the profits go to the investor, then the agent isn't considered a borrower. If so, he can take responsibility for the capital. He quotes that originally the Raavad argued with this leniency but seems to have retracted later. In the Ran himself he says that the agent can even be paid for his work. The Rama 177:1 cites this leniency as the halacha. Based on the Yerushalmi b"m 5:3 the Gra 177:5 supports this Rama but limits it to where the investor doesn't benefit. Chelkat Binyamin 177:16 writes that we are only lenient with this leniency if the borrower gains no benefit from the investment. That is, he isn't gaining a better reputation or is interested in getting another investment in the future with which he can make profits for himself. If he is gaining then he isn't an agent but rather a borrower since he is doing it for himself partially. In the Biurim he cites the Tiferet Lmoshe 170:2 who holds that even if there's any tangential benefit that the agent gains it is forbidden as we see from the case of a guarantor who doesn't personally gain from the loan but may not pay interest (Shulchan Aruch CM 170:1). Chelkat Binyamin disagrees.

- ↑ Gemara Bava Metsia 68a, 70b, Rashi 68a s.v. ein, Shulchan Aruch Y.D. 177:1