Categories of Ribbit: Difference between revisions

From Halachipedia

m (Text replacement - " Biblical" to " biblical") |

(→Sales) |

||

| (11 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

Lending money on interest is one of the more severe prohibitions in the torah.<ref> The Gemara BM 71a says that one who lends with interest becomes poor and never recovers. The Rambam Hilchot Malveh Viloveh 4:2 delineates six biblical prohibitions which could potentially be violated in any particular loan transaction. Ramban Sefer Hamitzvot Shoresh 6 adds a 7th. </ref> The lender, the borrower, the guarantor, the witnesses, and even the scribe violate when engaging in an interest-bearing loan.<ref> Mishna Bava Metzia 75b. Shulchan Aruch Y.D. 160:1</ref> | Lending money on interest is one of the more severe prohibitions in the torah. <ref> The Gemara BM 71a says that one who lends with interest becomes poor and never recovers. The Rambam Hilchot Malveh Viloveh 4:2 delineates six biblical prohibitions which could potentially be violated in any particular loan transaction. Ramban Sefer Hamitzvot Shoresh 6 adds a 7th. </ref> The lender, the borrower, the guarantor, the witnesses, and even the scribe violate when engaging in an interest-bearing loan. <ref> Mishna Bava Metzia 75b. Shulchan Aruch Y.D. 160:1</ref> | ||

== | ==Basics== | ||

# In any case where a person owes a debt to another Jew whether it is because he borrowed money or because he hired him and owes him or because he rented something and didn’t pay yet, it is forbidden to pay more than the actual debt because of the prohibition of taking interest.<Ref>Shulchan Aruch Y.D. 176:6, Rama Y.D. 161:1, The gemara Bava Metsia 63b explains that as long as one is paying extra to be able to hold the money for longer, it would be a violation of this prohibition. </ref> | # In any case where a person owes a debt to another Jew whether it is because he borrowed money or because he hired him and owes him or because he rented something and didn’t pay yet, it is forbidden to pay more than the actual debt because of the prohibition of taking interest. <Ref>Shulchan Aruch Y.D. 176:6, Rama Y.D. 161:1, The gemara Bava Metsia 63b explains that as long as one is paying extra to be able to hold the money for longer, it would be a violation of this prohibition. </ref> | ||

# It is prohibited to lend with interest even if the borrower is wealthy and willingly agrees to pay the interest.<ref> Shulchan Aruch YD 160:1,4. </ref> It is prohibited even in cases where it seems entirely fair such as reimbursing the lender for the interest he was earning while his money was in a non-Jewish bank.<ref> Iggerot Moshe YD 3:93 </ref> | # It is prohibited to lend with interest even if the borrower is wealthy and willingly agrees to pay the interest. <ref> Shulchan Aruch YD 160:1,4. </ref> It is prohibited even in cases where it seems entirely fair such as reimbursing the lender for the interest he was earning while his money was in a non-Jewish bank. <ref> Iggerot Moshe YD 3:93 </ref> | ||

# If neighbors have a good relationship and commonly borrow without being careful to return everything they borrow, then there is no prohibition of interest as the neighbors aren’t borrowing but rather gifting one another | # If neighbors have a good relationship and commonly borrow without being careful to return everything they borrow, then there is no prohibition of interest as the neighbors aren’t borrowing but rather gifting one another. <Ref> The Weekly Halachah Discussion (vol 2, pg 348) quoting The Laws of Interest (pg 35)</ref>However, if neighbors do not such a relationship then a neighbor who borrows a half a bag of sugar is borrowed only that amount may be returned unless the amount difference is insignificant (about which people don’t care) <Ref> The Weekly Halachah Discussion (vol 2, pg 348) quoting Brit Yehuda (Siman 17 note 6)</ref> or if one is unsure how much one borrowed one may return an amount to be sure the loan is repaid. <Ref> The Weekly Halachah Discussion (vol 2, pg 348) quoting Sh”t Minchat Yitzchak 9:88</ref> | ||

#Some explain that a key factor in determining if something is considered a loan is whether the item is fungible and normally traded; if it is always traded to be kept that is a sale. Another factor that is used is whether the type of item being lent is similar to the item that is being returned; if they’re dissimilar it is like a sale.<ref>Biurim in Chelkat Binyamin 161:1 s.v. dvar wrote that there’s a dispute between the Chavot Daat 161:1 and Mekor Mayim Chayim 161:1 why a loan of slaves isn’t loan but a sale. Chavot Daat explains that since each slave is unique and needs a significant evaluation it is considered a sale when you trade one for two later. His premise is that there’s no prohibition of a loan of one item for another like apples for oranges. However, the Mekor Mayim Chaim explains that since a person doesn’t give a slave to be loaned out or traded (lhotzah) but rather to be used it isn’t considered or termed a loan but a sale.</ref> | |||

#Some explain that a key factor in determining if something is considered a loan is whether the item is fungible and normally traded; if it is always traded to be kept that is a sale. Another factor that is used is whether the type of item being lent is similar to the item that is being returned; if they’re dissimilar it is like a sale.<ref>Biurim in Chelkat Binyamin 161:1 s.v. dvar wrote that there’s a dispute between the Chavot Daat 161:1 and Mekor Mayim Chayim 161:1 why a loan of slaves isn’t | #There is no prohibition of ribbit upon the borrower whenever it is rabbinic ribbit.<ref>Nemukei Yosef b”m 39b s.v. garsinan, Ritva there, Darkei Moshe 160:2, Rama 160:1</ref> | ||

#There is no prohibition of ribbit upon the borrower whenever it is rabbinic ribbit | |||

===Rentals=== | ===Rentals=== | ||

#It is forbidden to charge interest for a rental.<ref>Teshuvot Maimoniyot 15 records the opinion of Rabbi Eliezer Mtuch that interest is permitted for a rental. His proof is Macot 3a. However, the Bet Yosef 160:21 disagrees with this opinion.</ref> | #It is forbidden to charge interest for a rental.<ref>Teshuvot Maimoniyot 15 records the opinion of Rabbi Eliezer Mtuch that interest is permitted for a rental. His proof is Macot 3a. However, the Bet Yosef 160:21 disagrees with this opinion.</ref> | ||

| Line 41: | Line 11: | ||

# There is a dispute if money returned due to an erroneous sale is considered like a loan for the purposes of interest.<ref>Chatom Sofer YD 85 and Maharam Shik YD 161 dispute whether money that was taken because of a sale and then the sale falls through whether it is like a loan and it is permitted to pay interest or not. [https://www.hebrewbooks.org/pdfpager.aspx?req=1278&st=&pgnum=160&hilite= Maharshag 1:4] argues with the Maharam Shik.</ref> | # There is a dispute if money returned due to an erroneous sale is considered like a loan for the purposes of interest.<ref>Chatom Sofer YD 85 and Maharam Shik YD 161 dispute whether money that was taken because of a sale and then the sale falls through whether it is like a loan and it is permitted to pay interest or not. [https://www.hebrewbooks.org/pdfpager.aspx?req=1278&st=&pgnum=160&hilite= Maharshag 1:4] argues with the Maharam Shik.</ref> | ||

===Renting Coins=== | ===Renting Coins=== | ||

#It is forbidden to rent money to someone else because that is considered | #It is forbidden to rent money to someone else because that is considered Biblical interest.<ref>Rama Y.D. 176:1</ref> | ||

##There is a minority opinion that one can rent out coins if they stipulate that the renter is exempt from all responsibility including damages from theft, loss, and unexpected circumstances. Ashkenazim rely upon this opinion for rabbinic interest, while Sephardim reject this opinion.<ref>Rama Y.D. 176:1 accepts the Trumat Hadeshen 302, while in 177:6 he only uses it for rabbinic interest. Shach there opines that the Trumat Hadeshen is even relevant to | ##There is a minority opinion that one can rent out coins if they stipulate that the renter is exempt from all responsibility including damages from theft, loss, and unexpected circumstances. Ashkenazim rely upon this opinion for rabbinic interest, while Sephardim reject this opinion.<ref>Rama Y.D. 176:1 accepts the Trumat Hadeshen 302, while in 177:6 he only uses it for rabbinic interest. Shach there opines that the Trumat Hadeshen is even relevant to Biblical cases. Gra 176:2 completely rejects the Trumat Hadeshen. Bet Yosef 176:1 writes that the Trumat Hadeshen doesn’t actually allow it in practice.</ref> | ||

#If the person is planning on using the coins to show them off or to learn from them and isn’t going to be allowed to use them then It is permitted to rent them just like one can rent out any utensil.<ref>Tosefta, Tosfot Bava Metsia 69b, Shulchan Aruch Y.D. 176:1</ref> | #If the person is planning on using the coins to show them off or to learn from them and isn’t going to be allowed to use them then It is permitted to rent them just like one can rent out any utensil.<ref>Tosefta, Tosfot Bava Metsia 69b, Shulchan Aruch Y.D. 176:1</ref> | ||

## If one is renting coins for show or learning purposes the borrower can’t accept responsibility for the coins if there’s an unexpected circumstance in which the coins are damaged.<ref>Rama Y.D. 176:1</ref> | ## If one is renting coins for show or learning purposes the borrower can’t accept responsibility for the coins if there’s an unexpected circumstance in which the coins are damaged.<ref>Rama Y.D. 176:1</ref> | ||

| Line 48: | Line 18: | ||

# It is permitted to rent utensils even if the renter has permission to sell them and replace them.<ref>Tur and Shulchan Aruch Y.D. 176:2</ref> However, one can’t do this with utensils that don’t depreciate with use such as gold or silver utensils.<Ref>Taz 176:1</ref> | # It is permitted to rent utensils even if the renter has permission to sell them and replace them.<ref>Tur and Shulchan Aruch Y.D. 176:2</ref> However, one can’t do this with utensils that don’t depreciate with use such as gold or silver utensils.<Ref>Taz 176:1</ref> | ||

# It is forbidden to rent out a car, ship, or pot such that they pay rent and if the item breaks the renter must pay for the value of the item at the time of the damage.<ref>Shulchan Aruch Y.D. 176:3</ref> This is only permitted for items that depreciate with use.<ref>Rama 176:3</ref> | # It is forbidden to rent out a car, ship, or pot such that they pay rent and if the item breaks the renter must pay for the value of the item at the time of the damage.<ref>Shulchan Aruch Y.D. 176:3</ref> This is only permitted for items that depreciate with use.<ref>Rama 176:3</ref> | ||

## According to Ashkenazim they may not stipulate that if it breaks then the renter should pay the value of the item when it was originally rented. According to Sephardim this is permitted.<ref>Shulchan Aruch and Rama 176:4. The Rambam Malveh Vloveh 8:13 holds that it is permitted to stipulate that the renter will pay the original value of the rented item if it breaks since if it is still around it can be returned as such even if it is worth less due to ware or market fluctuation. Bet Yosef 176:4 cites that the Rashba 69b, Ran 69b, and Mordechai b”m 5:330 agree with the Rambam. On the other hand, the Tur 176:4 holds that doing so is forbidden since the obligation of paying back the original value of the item indicates that it was like a loan and the rent was interest. Rabbenu Yerucham 1:27b agrees and thinks that it is only rabbinic interest, while Ramban b”m 70a s.v. ha damrinan is similarly strict but isn’t sure if it is rabbinic or | ## According to Ashkenazim they may not stipulate that if it breaks then the renter should pay the value of the item when it was originally rented. According to Sephardim this is permitted.<ref>Shulchan Aruch and Rama 176:4. The Rambam Malveh Vloveh 8:13 holds that it is permitted to stipulate that the renter will pay the original value of the rented item if it breaks since if it is still around it can be returned as such even if it is worth less due to ware or market fluctuation. Bet Yosef 176:4 cites that the Rashba 69b, Ran 69b, and Mordechai b”m 5:330 agree with the Rambam. On the other hand, the Tur 176:4 holds that doing so is forbidden since the obligation of paying back the original value of the item indicates that it was like a loan and the rent was interest. Rabbenu Yerucham 1:27b agrees and thinks that it is only rabbinic interest, while Ramban b”m 70a s.v. ha damrinan is similarly strict but isn’t sure if it is rabbinic or Biblical interest.</ref> | ||

===Rentals of Real Estate=== | ===Rentals of Real Estate=== | ||

#It is permitted to stipulate two prices for rent, one for immediate payment and a higher rate for paying at the end. The reason is that since one is only obligated to pay rent at the end, paying at the beginning at a discount isn’t the real price and is permitted.<ref>Gemara Bava Metsia 65a, Tur and Shulchan Aruch Y.D. 176:6</ref> However, many hold that nowadays this leniency won’t apply since the practice in many places is to have the rent due from the beginning of the month or rental period. If so, it would be forbidden to have a two tiered system for the price of rent.<ref>Torat Ribbit 14:7 writes that if in a certain place it is assumed that rent is due at the beginning of the rental and not the end, the Chachmat Adam 136:10 forbids offering two prices for rent. His reason is that once the rent is due immediately it is considered a sale and offering a more expensive price later is forbidden. He also quotes that the Machaneh Efraim 31 writes that it is permitted since essentially it is due at the end but the practice is just to have a condition to pay it up front it is no different than in the days of the gemara. Torat Ribbit himself adds a leniency if it is clear that the price for the payment at the end is the fair market price and the earlier price is a discount that it could be permitted based on the Chachmat Adam 139:5.</ref> | #It is permitted to stipulate two prices for rent, one for immediate payment and a higher rate for paying at the end. The reason is that since one is only obligated to pay rent at the end, paying at the beginning at a discount isn’t the real price and is permitted.<ref>Gemara Bava Metsia 65a, Tur and Shulchan Aruch Y.D. 176:6</ref> However, many hold that nowadays this leniency won’t apply since the practice in many places is to have the rent due from the beginning of the month or rental period. If so, it would be forbidden to have a two tiered system for the price of rent.<ref>Torat Ribbit 14:7 writes that if in a certain place it is assumed that rent is due at the beginning of the rental and not the end, the Chachmat Adam 136:10 forbids offering two prices for rent. His reason is that once the rent is due immediately it is considered a sale and offering a more expensive price later is forbidden. He also quotes that the Machaneh Efraim 31 writes that it is permitted since essentially it is due at the end but the practice is just to have a condition to pay it up front it is no different than in the days of the gemara. Torat Ribbit himself adds a leniency if it is clear that the price for the payment at the end is the fair market price and the earlier price is a discount that it could be permitted based on the Chachmat Adam 139:5.</ref> | ||

# Even when or where it is permitted to charge extra for rent it is only permitted when stipulated in advance of the renter beginning to rent. It can not be stipulated once he already began his rental period<ref>Talmid Harashba 65a, Bet Yosef 176:6, Darkei Moshe 176:3, Rama 176:6. Bet Yosef has a doubt whether this constitutes | # Even when or where it is permitted to charge extra for rent it is only permitted when stipulated in advance of the renter beginning to rent. It can not be stipulated once he already began his rental period<ref>Talmid Harashba 65a, Bet Yosef 176:6, Darkei Moshe 176:3, Rama 176:6. Bet Yosef has a doubt whether this constitutes Biblical or rabbinic interest.</ref> and certainly not after the rental period has finished.<ref>Shulchan Aruch Y.D. 176:6. Taz 176:8 ventures that this is Biblical interest even according to the Bet Yosef since the obligation to pay after the rental period is halachically considered a loan. Shach in Nekudat Hakesef 176:3 disagrees and thinks that the Bet Yosef’s unresolved quandary is still relevant since the obligation was generated by a rental. Chelkat Binyamin 176:67 cites both the Shach and Taz. He adds that there’s an additional reason to assume it is rabbinic; according to the Rambam (cited in 166:2) all interest that isn’t obligated from the time of the loan is rabbinic.</ref> | ||

# When and where it is permitted to have a two tiered rent system it is even permitted when the renter makes this stipulation and payment significantly before he begins the rental.<ref>Bet Yosef 176:6 quotes the Hagahot Maimoniyot in the name of the Baalei Hatosfot Rashba says that it is forbidden to have a two tiered system when the renter doesn’t start immediately upon agreement of the rent. Doing so would appear as interest since it appears as though the payment is a loan in order for the owner to offer a discount. Yet, the Maggid Mishna cites the Rashba, Rav Shlomo Ben Aderet, as being lenient since the acquisition of the rental is complete once the rental price is finalized. That acquisition makes it a real rental and not a loan even from the moment of the agreement. Chelkat Binyamin (Tziyunim 176:167 and Biurim) clarifies that this means that the acquisition for the rental acquires him the house with respect to being able to live there when the rental will begin (unlike the Nekudat Hakesef 176:1 who implies that it means that it is completely in the possession of the renter immediately). Nekudat Hakesef 176:1 follows the Rashba, Rav Shlomo Ben Aderet.</ref> | # When and where it is permitted to have a two tiered rent system it is even permitted when the renter makes this stipulation and payment significantly before he begins the rental.<ref>Bet Yosef 176:6 quotes the Hagahot Maimoniyot in the name of the Baalei Hatosfot Rashba says that it is forbidden to have a two tiered system when the renter doesn’t start immediately upon agreement of the rent. Doing so would appear as interest since it appears as though the payment is a loan in order for the owner to offer a discount. Yet, the Maggid Mishna cites the Rashba, Rav Shlomo Ben Aderet, as being lenient since the acquisition of the rental is complete once the rental price is finalized. That acquisition makes it a real rental and not a loan even from the moment of the agreement. Chelkat Binyamin (Tziyunim 176:167 and Biurim) clarifies that this means that the acquisition for the rental acquires him the house with respect to being able to live there when the rental will begin (unlike the Nekudat Hakesef 176:1 who implies that it means that it is completely in the possession of the renter immediately). Nekudat Hakesef 176:1 follows the Rashba, Rav Shlomo Ben Aderet.</ref> | ||

# If a person is renting a field for work for a certain price and also offers the renter a loan in order to invest in the field itself, they can arrange that the rental price will be higher because of this loan.<ref>Gemara Bava Metzia 69b, Tur and Shulchan Aruch Y.D. 176:5. Baal Hatrumot 46:4:48 cited by Bet Yosef 176:5 quotes Rabbenu Moshe who says that it is forbidden to have the renter pay back the loan as well as the higher rent. Rather he should pay for the higher rent and not the capital of the loan. Bet Yosef comments that this Rabbenu Moshe isn’t the Rambam who makes no mention of this qualification. Indeed, the Chelkat Binyamin (176 fnt. 134) notes that the Shulchan Aruch and commentaries don’t make this qualification either and as such we don’t follow it.</ref> This is only permitted even after the rental begins before the rental is due.<ref>Chelkat Binyamin 176:44</ref> | # If a person is renting a field for work for a certain price and also offers the renter a loan in order to invest in the field itself, they can arrange that the rental price will be higher because of this loan.<ref>Gemara Bava Metzia 69b, Tur and Shulchan Aruch Y.D. 176:5. Baal Hatrumot 46:4:48 cited by Bet Yosef 176:5 quotes Rabbenu Moshe who says that it is forbidden to have the renter pay back the loan as well as the higher rent. Rather he should pay for the higher rent and not the capital of the loan. Bet Yosef comments that this Rabbenu Moshe isn’t the Rambam who makes no mention of this qualification. Indeed, the Chelkat Binyamin (176 fnt. 134) notes that the Shulchan Aruch and commentaries don’t make this qualification either and as such we don’t follow it.</ref> This is only permitted even after the rental begins before the rental is due.<ref>Chelkat Binyamin 176:44</ref> | ||

| Line 65: | Line 35: | ||

===Lending an Object=== | ===Lending an Object=== | ||

# It is permitted to lend an object such as a tool to one's friend even on condition that if it breaks he will get you a new one even though it is more expensive than the one you lent him.<Ref>Mishnat Ribbit 4:35 based on Chavot Daat 161:1</ref> | # It is permitted to lend an object such as a tool to one's friend even on condition that if it breaks he will get you a new one even though it is more expensive than the one you lent him.<Ref>Mishnat Ribbit 4:35 based on Chavot Daat 161:1</ref> | ||

=== | ===Stolen Money=== | ||

# If a person stole money he can return it together with interest since it wasn't a loan.<ref>Brit Yehuda 2:17</ref> | # If a person stole money he can return it together with interest since it wasn't a loan.<ref>Brit Yehuda 2:17</ref> | ||

# For example, if a person invested money with an agent and the agent stole that money for himself. The agent is not obligated to pay any interest upon the money he stole, however, if he does give it then the it is permitted for him to give it and the investor to take it since it wasn't a loan after it was stolen.<ref>Shulchan Aruch Y.D. 177:19</ref> | # For example, if a person invested money with an agent and the agent stole that money for himself. The agent is not obligated to pay any interest upon the money he stole, however, if he does give it then the it is permitted for him to give it and the investor to take it since it wasn't a loan after it was stolen.<ref>Shulchan Aruch Y.D. 177:19</ref> | ||

== | ==Borrowing Someone's Credit Card== | ||

===Land or Documents | [[Image:Borrowing cc.jpg|250px|right]] | ||

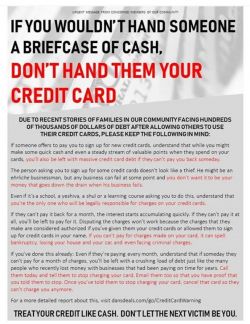

# Ribbit applies to lending land in order to receive more in return or the same land together with something else in return. This is considered | # It is permitted for someone to borrow another Jew's credit card to pay for a purchase and repay them the amount spent. Even if the purchaser receives points from the credit card company, that isn't considered interest since it doesn't come from the borrower. Additionally, the borrower may not the purchaser for any interest fees that the purchaser may incur if he pays late.<ref>[http://www.torah.org/advanced/weekly-halacha/5762/behar.html Rabbi Doniel Neustadt on torah.org], [https://www.chabad.org/library/article_cdo/aid/4387029/jewish/Can-I-Lend-Out-My-Credit-Card-to-Earn-Points.htm chabad.org], and [http://www.dinonline.org/2014/01/17/receiving-points-from-credit-card-loan/ dinonline.org].</ref> If the borrowing is done in a way that it is assumed that if the borrower won't pay on time he will have to pay the interest fees, such as is common with large amounts, it would be forbidden to lend your credit card.<ref>Chelkat Binyamin 170:17 describes the issue of borrowing credit cards at length. When someone borrows a credit card and uses it, he is considered as though he borrowed from the credit card company and the credit card holder is a guarantor to pay the debt to the company. Indeed it can be even more serious if it is viewed as though the credit card holder borrowed from the credit card company since he is indebted to them and separately he lent that money to his friend who is using his credit card. Either way if the agreement was that the borrower of the credit card would pay the credit card holder interest if he didn't pay on time that is a forbidden arrangement even if they pay on time and never engage in interest. However, if they arranged that the borrower wouldn't have to pay the interest even in the event that he didn't pay on time then it is permitted. For small purchases it can be assumed that the arrangement was that the borrower would only pay for the capital and not interest if he didn't pay on time. | ||

* The reason that the points are permitted is because they are considered a gift from a third party and not the Jewish lender to the Jewish borrower (see Shulchan Aruch 160:13 and Shach 160:20).</ref> | |||

# It is problematic to borrow someone else's credit card if there are two prices for a certain product, a cheaper price for cash and more expensive for credit. Since there are two prices we can view the cash price as the real price and the credit card price as the convenience price. Once the borrower of the credit card uses the card to buy a product that is worth less than the credit card price and repays the credit card price he is giving interest to the credit card holder.<ref>Chelkat Binymain Biurim 170:1 s.v. ela p. 392</ref> | |||

==Partnerships== | |||

# It is forbidden for several Jews, two or more, to borrow from a bank or non-Jew with interest such that the non-Jew can collect from any one of them. The reason is that if one of them pays then the others are obligated to repay the one who paid the interest. Thereby the one who paid would be like he lent everyone else with interest and is being repaid with interest.<ref>Chavot Daat 170:1, Chelkat Binyamin 170:25 based on Graz 64 and Chavot Daat</ref> Solutions include: specifying that if one of them pays on behalf of everyone that everyone will repay the one who paid the capital and not interest and the one who paid the bank or non-Jew will lose out on the interest. Another solution is to specify with the bank or non-Jew that every borrower is only obligated up to a specific amount and there's no obligation of one borrower for another.<ref>Chelkat Binyamin 170:25</ref> | |||

# If a Jew borrows on behalf of a Jewish partner or Jewish company from a bank or non-Jew with interest and then uses the partner or company's money to repay the loan that is considered interest. This is forbidden since the one signing is considered to have borrowed with interest and when he invests that money with the partner or company he is further lending it to another Jew with interest.<ref>Taz 170:3</ref> However, it is permitted if they originally borrowed in the name of all the partners or the entire company (aside from the other issue of the previous halacha, that one borrower can't be responsible for the entire loan).<ref>Chelkat Binyamin 170:25</ref> | |||

# If a Jew borrows on behalf of a Jewish partner or Jewish company for a bank or non-Jew with interest as an investment to the partnership or company and he is working in the partnership or company some poskim are lenient.<ref>Taz 170:3 is lenient. Chavot Daat 170:1 is strict unless the other partner is unaware of the fact that the partner borrowed with interest. Also Chavot Daat is only lenient to pay the interest with the profits.</ref> The halacha is that it is permitted to pay off the interest from the profits that were made with the money that was invested but they should not be taken from the partnership or company if the interest is greater than the profits made from that money.<ref>Chelkat Binyamin 170:25 based on Graz</ref> | |||

==Rabbinic Prohibition of Interest== | |||

# There are several different forms of interest that are prohibited only rabbinically. There are several practical differences if it is only rabbinic. For example, Rabbinic interest was not extended to charities. <ref> Shulchan Aruch and Rama YD 160:18 </ref> Additionally, one who receives biblical interest must return it but this does not apply to certain cases of rabbinic interest. <ref> Shulchan Aruch YD 161:2 </ref> | |||

# It is permitted for the yeshiva to give out student loans for tuition with interest since it is only a rabbinic form of interest in that the money was never given to the students to spend and a yeshiva is allowed to taking rabbinic forms of interest.<ref>[https://www.yutorah.org/sidebar/lecture.cfm/900500/rabbi-hershel-schachter/dinei-ribbis/ Rav Hershel Schachter (Dinei Ribbis min 35-40)] explained that it is permitted for a yeshiva to lend money on interest for student tuition loans since the money isn't given to the students as a loan and then repaid, it is used to pay off the debt for classes and services provided. Postponing paying for a service isn't derech halvah, the nature of borrowing, and therefore only a rabbinic form of interest, which is permitted for a yeshiva.</ref> | |||

==Involvement with Interest== | |||

#Anyone involved in the interest transaction, such as the lender, buyer, witnesses, scribe, or another intermediary is violating the halacha of ribbit.<ref>Bava Metsia 75b, Tur and Shulchan 160:1, Shach 160:1</ref> | |||

# It is forbidden to give a gift when returning a loan when if one doesn’t specify that it is because of the loan.<ref>Rashi 73b s.v. achulei implies that as long as one doesn’t specify that a gift isn’t because of the loan it is permitted even at the time of returning the loan. However, the Rosh b”m 5:67 argues that it is only permitted after payment of the loan. Bet Yosef 160:4 cites the Talmidei Harashba who says that it is only permitted to give an extra gift if it was a sale and not a loan.</ref> | |||

==Appearance of Interest== | |||

# It is forbidden to couple a fair transaction together with a loan because it appears as interest. For example, a person can't offer an employer an interest free loan and have the employer hire him for a fair wage. Even if the wage is fair and would have been paid even if not for the loan, it is forbidden when they discuss it as part of the same transaction. Furthermore, it is even forbidden if they explicitly state that they are two separate transactions<ref>Maharam cited by Mordechai b"m 316, Shulchan Aruch 177:13. Shach 177:28 clarifies that it is forbidden even though it is a fair wage and would have happened anyway as the Maharam described.</ref> unless they are done at separate occasions.<ref>Chelkat Binyamin 166:48 citing Levush and Chachmat Adam</ref> | |||

# It would be permitted if they did the other transaction and then instead of doing a loan, they did a gift and the other party could return the gift but didn't have to.<ref>Maharam cited by Mordechai b"m 316, Shulchan Aruch 177:13, Rama 166:3. Gra 177:34 in fact argues that it is forbidden according to the Rashba since it has the appearance of a legal subterfuge of interest. He is in disagreement with the Bet Yosef's understanding that the Maharam and Rashba are not at odds.</ref> | |||

==Legal Subterfuge== | |||

# A person asks for a loan of $100 and the lender isn't interested. The lender counter offers him to lend him $100 worth of a commodity and he can sell it for that value and use the money. Then the borrower takes the commodity worth a $100 and offers the lender to buy back the commodity for $90. If the buyer accepts that deal it is forbidden since in effect the borrower borrowed $90 and is obligated to return $100 which is interest.<ref>Bava Metsia 62b, Shulchan Aruch Y.D. 163:3</ref> | |||

# This is considered legal subterfuge and even though it is forbidden to arrange, if it is already arranged, according to Sephardim the borrower can repay the full loan. However, according to Ashkenazim the the borrower shouldn't repay the full value of the loan since this is considered rabbinic interest.<ref>Shulchan Aruch and Rama 163:3</ref> | |||

# If between the time of the loan and the time of the resale of the commodity to the lender the price of the commodity dropped to $90 then it is permitted to sell the commodity back to the lender.<ref>Taz 163:6</ref> | |||

# If the borrower never took the commodity but everything was transacted orally it is considered rabbinic interest in all circumstances.<ref>Shach 163:6</ref> | |||

# If the borrower stipulated with the lender that they would go through with this entire series of transactions it is certainly interest.<ref>Rama 163:3. Rama implies it is Biblical interest while the Bach cited by Shach 163:11 explains that it is only rabbinic interest.</ref> | |||

# There is a dispute if it is permitted if the borrower only sells the commodity back to the lender at another time.<ref>Taz 163:7 is lenient since it doesn't appear like interest but two separate transactions. Nekudat Hakesef 163:3 forbids. Chelkat Binyamin 164:27 additionally cites the Graz, Tiferet Lmoshe, and Avnei Nezer who are strict, unlike the Chachmat Adam who is lenient.</ref> | |||

===Renting a Field to a Borrower=== | |||

# A person borrowed money and as a collateral gave the lender a field. Generally, the lender may not make use of that field without certain conditions. The lender then rents out the field to the borrower for a fixed rate. That is considered legal subterfuge to charge a borrower interest on his loan and is forbidden.<ref>Gemara Bava Metsia 68a, Shulchan Aruch Y.D. 164:1. Shach 164:1 explains that Shulchan Aruch holds like Rashi that doing so is Biblical interest.</ref> | |||

# If the entire series of transactions were stipulated from the beginning it is certainly forbidden.<Ref>Rama 164:1</ref> | |||

# If the field as a collateral was used by the lender and for that use a deduction was made to the loan for each year until the entire loan would be paid off, then if there is someone else in between the borrower and lender it is permitted. That is, if the lender rents out the field to someone else and that person then lends it to the borrower it is permitted.<ref>Shulchan Aruch 163:2, 172:2</ref> | |||

# It is permitted to sell a field to someone and then rent it from them.<ref>Shulchan Aruch 164:3</ref> | |||

==Late Fees== | |||

===Loans=== | |||

# It is forbidden to charge or pay a late fee for a payment that is due. Having such a fee is a subterfuge of interest.<ref>Bet Yosef 177:14 cites a dispute between the Baal Hatrumot 4:32 and Ri Migash on the one hand, and the Rashba (teshuva 2:2, meyuchasot 221, 175) and Rabbenu Yerucham 16 on the other. The first group of rishonim held that it is permitted to have a late fee for a payment since it doesn't accrue over time. The second group says that it is forbidden because of it is a legal subterfuge around interest. Shulchan Aruch and Rama Y.D. 177:14 accept the Rabbenu Yerucham and Rashba.</ref> It is forbidden even on a one time basis and all the more if the late fee is recurring.<ref>Bet Yosef and Darkei Moshe 177:16 cite a heter iska document of the Ri Morleans who constructed a loan document with interest and replaced interest with late fees being considered presents. Either way, the Bet Yosef completely disregards this suggestion and claims it is absolutely interest. The Shach 177:33 holds that it is Biblical interest, while he also cites the Mabit who thinks it is only rabbinic interest.</ref> | |||

# It is equally forbidden if it is a loan with a collateral.<ref>Shulchan Aruch Y.D. 177:17</reF> | |||

# It is permitted to pay a late fee with a commodity and not cash. That doesn't have the appearance of paying interest.<ref>Rivash 335, Rama 177:14, Shach 177:30. There is a discussion if Shulchan Aruch agrees with this ruling. In Shulchan Aruch Y.D. 177:17 he forbids late fees with a loan such that the lender can keep the collateral which is worth more than the loan and seems to contradict this Rama. Shcah 177:35 tries to answer that Shulchan Aruch agrees with the Rama, however, with a collateral it is forbidden since it has more of the appearance of interest than a regular payment with commodities. Yet, even this would be permitted with a land collateral since it even less has the appearance of interest with land as there's no fixed price for land.</ref> | |||

===Gifts=== | |||

# If someone agrees to give a complete gift and stipulates that if he doesn't give it at a certain date then he will add another gift that is permitted. However, once he completed his initial offer and is obligated to fulfill it, it is forbidden to then stipulate that if he doesn't fulfill it on time he will add a gift at a later date. This is relevant to dowries as well.<ref>Shulchan Aruch Y.D. 177:15, 176:6</ref> | |||

===Sales=== | |||

# It is permitted for a person to stipulate that if he doesn't deliver a product by a certain date he will have to pay a late fee. Even though generally late fees are considered like interest, it is permitted in the case of a sale since it isn't a loan in essence.<reF>Shulchan Aruch Y.D. 177:18</ref> Nonetheless, it is is only permitted to have a one time late fee. It would be forbidden to stipulate that at every week or any other interval that it isn't delivered there is an increasing late fee. Have such a recurring late fee is interest even with sales.<ref>Chelkat Binyamin 177:164</ref> | |||

# Some only permit a late fee with a sale if it is structured such that after the late fee is incurred it can be paid immediately or over a certain period of time. If it is stipulated that the late fee once incurred is not due to be paid until a later date, some say that it is forbidden, while others permit it.<ref>The Bach forbids, while Taz 177:23 permits. Shach 177:37 according to the old version forbids it, but according to the Chavot Daat's emendation permits it. Chelkat Binyamin 177:160 has a long discussion of this point and in conclusion is strict like the Taz as is the ruling of the Chachmat Adam 132:13.</ref> | |||

==Judging by the Time of Stipulation== | |||

# It is considered Biblical ribbit to lend 100 items to get 120 items in return, even if at the time of the return those 120 items afterwards are the same price as the 100 items were at the time of the original loan.<ref>Gemara Bava Metsia 60b, Shulchan Aruch Y.D. 160:21</ref> | |||

# It is considered rabbinic ribbit to lend 100 items to get 100 items in return even if at the time of the return those 100 items are worth more than the price of the 100 items were originally.<ref> The reason that this is only rabbinic ribbit and not Biblical ribbit is because we judge the situation whether something is ribbit or not based on the stipulation at the time of the loan. That is the ruling of the Shach YD 160:35 and Gra 160:53. This is also the opinion of the Ritva 61b s.v. vtisbara, Ran, and Talmid Harashba cited by Bet Yosef 160:21. However, the Hagahot Ashri 6:1 writes that this was the doubt of the gemara whether we judge the deal from the stipulation or the time of the return and if we judge it by the time of the return it is considered ribbit. This case might therefore be ribbit Biblically. The Granat explains that even the Hagahot Ashri only considers it Biblical ribbit if it is an exchange of currency which is uncommon but not with actual commodities which is certainly rabbinic. </ref> | |||

==Land or Documents== | |||

# Ribbit applies to lending land in order to receive more in return or the same land together with something else in return. This is considered Biblical ribbit.<Ref>Tosfot Bava Metsia 61a s.v. im holds that based on a klal uprat uklal land is excluded from the laws of ribbit. Rosh b”m 5:1 and Ran b”m 61a s.v. karkaot agrees. Tur 161:1 cites Ri who agrees. Bet Yosef cites the Rabbenu Yerucham who is strict. The Rabbenu Yerucham 1:8 is citing the Rashba b”m 61a minayin, however, in our versions of the Rashba it seems in conclusion he is lenient. The Bet Yosef isn’t certain if there’s a rabbinic prohibition even according to Tosfot. Taz 161:1 says obviously there is a rabbinic prohibition. Certainly Tosfot adds that money to receive some land or benefit from land is forbidden. The Shach 161:1 and Taz 161:1 who point out that Shulchan Aruch 161:1 seems to be strict. See Gra 161:1 who might be lenient to consider it only a rabbinic prohibition. </ref> | |||

# Ribbit applies to money given in a document.<ref>Rosh Bava Metsia 5:1 writes that theoretically documents should be excluded from ribbit because of a klal uprat. However, he notes that there’s no case of a loan with a document, giving a loan to receive it return with an interest on the side is a rental. Bet Yosef 161:1 asks why it isn’t considered a loan to give a document of debt that is worth 100 to receive in return a document of debt of 200. Bach 161:1 and Taz 161:1 both argue that such a deal would certainly be ribbit since the document merely represents money.</ref> | # Ribbit applies to money given in a document.<ref>Rosh Bava Metsia 5:1 writes that theoretically documents should be excluded from ribbit because of a klal uprat. However, he notes that there’s no case of a loan with a document, giving a loan to receive it return with an interest on the side is a rental. Bet Yosef 161:1 asks why it isn’t considered a loan to give a document of debt that is worth 100 to receive in return a document of debt of 200. Bach 161:1 and Taz 161:1 both argue that such a deal would certainly be ribbit since the document merely represents money.</ref> | ||

==Mitzvot== | |||

#Regarding leniencies for taking interest for a Mitzvah see [[Corporations_and_Partnerships#Non-Profits]] | #Regarding leniencies for taking interest for a Mitzvah see [[Corporations_and_Partnerships#Non-Profits]] | ||

==Ribbit for Pikuach Nefesh== | |||

#It is permitted to borrow from a Jew with interest in order to save someone’s life. That is only if borrowing from a non-Jew with interest isn’t an option that would allow saving the person’s life. <ref> | |||

#It is permitted to borrow from a Jew with interest in order to save someone’s life. That is only if borrowing from a non-Jew with interest isn’t an option that would allow saving the person’s life.<ref> | |||

* Shulchan Aruch Y.D. 160:22 writes that it is permitted to borrow with interest in order to save someone’s life. Taz 160:21 is bothered what is the point since it is obvious that it is permitted to violate any sin (besides idolatry, illicit relations, and murder). Bet Lechem Yehuda writes that it is permitted to borrow with interest from a Jew even if a non-Jew is available but it’ll take longer and in order to save time one can borrow from the Jew if it is quicker and could impact saving the person. | * Shulchan Aruch Y.D. 160:22 writes that it is permitted to borrow with interest in order to save someone’s life. Taz 160:21 is bothered what is the point since it is obvious that it is permitted to violate any sin (besides idolatry, illicit relations, and murder). Bet Lechem Yehuda writes that it is permitted to borrow with interest from a Jew even if a non-Jew is available but it’ll take longer and in order to save time one can borrow from the Jew if it is quicker and could impact saving the person. | ||

* Why does pikuach nefesh allow violating lifnei iver? Shulchan Aruch O.C. 306:14 rules that in order to protect someone from getting involved with a great sin it is permitted to sin a small sin, even if that involves violating Shabbat. If so we see that it is like pikuach nefesh to save someone from spiritual destruction. Why then is it permitted to cause someone sin in order to save someone else? | * Why does pikuach nefesh allow violating lifnei iver? Shulchan Aruch O.C. 306:14 rules that in order to protect someone from getting involved with a great sin it is permitted to sin a small sin, even if that involves violating Shabbat. If so we see that it is like pikuach nefesh to save someone from spiritual destruction. Why then is it permitted to cause someone sin in order to save someone else? | ||

* Tosfot Shabbat 4a s.v. vchi writes that the principle that one could save someone else from sinning by sinning oneself doesn’t apply if they entered the situation by negligence. This is codified by the poskim such as Magen Avraham 306:28 and Mishna Brurah 306:56. Rabbi Baruch Pesach Mendelson (Bet Yitzchak v. 39 p. 730 explained that there is no mitzvah of arvut when the person got into the situation of sin by his own negligence. Therefore, it is forbidden to save him from sin by sinning yourself. | * Tosfot Shabbat 4a s.v. vchi writes that the principle that one could save someone else from sinning by sinning oneself doesn’t apply if they entered the situation by negligence. This is codified by the poskim such as Magen Avraham 306:28 and Mishna Brurah 306:56. Rabbi Baruch Pesach Mendelson (Bet Yitzchak v. 39 p. 730 explained that there is no mitzvah of arvut when the person got into the situation of sin by his own negligence. Therefore, it is forbidden to save him from sin by sinning yourself. | ||

* Eretz Tzvi 2:20 writes that violating Shabbat to save someone from a violation of Shabbat isn't pikuach nefesh. Otherwise the gemara Shabbat 4a wouldn't have had a safek about this. Also, Tosfot 4a says that we wouldn't violate Shabbat if he was negligent but if it really was pikuach nefesh we would violate Shabbat even if he was negligent to become sick. </ref> The lender is doing wrong by lending with interest but nonetheless one doesn’t need to worry about causing him to sin if one is trying to save someone’s life.<ref>Taz 160:21 writes that it is obvious that the lender with interest is doing wrong and really he has an obligation to spend in order to save the person.</ref> | * Eretz Tzvi 2:20 writes that violating Shabbat to save someone from a violation of Shabbat isn't pikuach nefesh. Otherwise the gemara Shabbat 4a wouldn't have had a safek about this. Also, Tosfot 4a says that we wouldn't violate Shabbat if he was negligent but if it really was pikuach nefesh we would violate Shabbat even if he was negligent to become sick. </ref> The lender is doing wrong by lending with interest but nonetheless one doesn’t need to worry about causing him to sin if one is trying to save someone’s life.<ref>Taz 160:21 writes that it is obvious that the lender with interest is doing wrong and really he has an obligation to spend in order to save the person.</ref> | ||

== | ==Mechila in Advance== | ||

#It is forbidden to take a loan in order to pay back interest as a gift even though it is a willing and intentional gift.<ref>The Geonim cited by Rambam Malveh Vloveh 4:13 argue that obviously it is forbidden to give interest as even though one forgives it knowingly because that is every case of interest and yet it is forbidden. The Maggid Mishna points out that the Rambam agrees with the Geonim on this contention. Rosh b”m 5:2 agrees as well. Shulchan Aruch Y.D. 161:6 codifies this opinion. | #It is forbidden to take a loan in order to pay back interest as a gift even though it is a willing and intentional gift. <ref>The Geonim cited by Rambam Malveh Vloveh 4:13 argue that obviously it is forbidden to give interest as even though one forgives it knowingly because that is every case of interest and yet it is forbidden. The Maggid Mishna points out that the Rambam agrees with the Geonim on this contention. Rosh b”m 5:2 agrees as well. Shulchan Aruch Y.D. 161:6 codifies this opinion. | ||

* Yet, the Mishna Lemelech 4:13 writes that it is permitted to forgive paying the interest in advance for rabbinic loans and that is permitted. His proof is that the Gemara Bava Metsia 75a and Rambam 4:9 permit rabbis to lend with interest since it is understood to be a complete gift and the Maggid Mishna says that it isn’t stipulated interest but interest after the fact. However, Shach 160:6 rules based on the Tur that it is forbidden to give interest even as a gift even if it isn’t stipulated in advance.</ref> | * Yet, the Mishna Lemelech 4:13 writes that it is permitted to forgive paying the interest in advance for rabbinic loans and that is permitted. His proof is that the Gemara Bava Metsia 75a and Rambam 4:9 permit rabbis to lend with interest since it is understood to be a complete gift and the Maggid Mishna says that it isn’t stipulated interest but interest after the fact. However, Shach 160:6 rules based on the Tur that it is forbidden to give interest even as a gift even if it isn’t stipulated in advance.</ref> | ||

# It is ineffective and forbidden to arrange in advance that someone will pay you interest and then forgive the interest so that it shouldn’t need to be returned.<ref>Bedek Habayit 160:5 cites that Ritva 61 a.s. Ma who writes that if a person forces his borrower to swear that after the loan he will forgive the interest because a forced mechila isn’t valid.</ref> | # It is ineffective and forbidden to arrange in advance that someone will pay you interest and then forgive the interest so that it shouldn’t need to be returned.<ref>Bedek Habayit 160:5 cites that Ritva 61 a.s. Ma who writes that if a person forces his borrower to swear that after the loan he will forgive the interest because a forced mechila isn’t valid.</ref> | ||

#Regarding Mechila after the fact see [[Returning Interest That Was Wrongly Collected#Mechila After the Fact]] | #Regarding Mechila after the fact see [[Returning Interest That Was Wrongly Collected#Mechila After the Fact]] | ||

===Taking Interest Temporarily | ==Matana Al Menat Lehachzir== | ||

#If the borrower gives the lender a temporary gift that will later be returned in addition to the capital that is considered ribbit.<ref>Rama 160:5</ref> | |||

==Taking Interest Temporarily== | |||

# It is forbidden to take interest even if one will return it afterwards. Some say that this is only a rabbinic prohibition.<ref>Taz 174:5. Netivot Moshe Ribbit on Taz 174:5 writes that there's no clear source why it is rabbinic but the Chidushei Maharaal 174:15 and Brit Yehuda 1:13 citing Har Hamor 17 also hold that it is rabbinic.</ref> | # It is forbidden to take interest even if one will return it afterwards. Some say that this is only a rabbinic prohibition.<ref>Taz 174:5. Netivot Moshe Ribbit on Taz 174:5 writes that there's no clear source why it is rabbinic but the Chidushei Maharaal 174:15 and Brit Yehuda 1:13 citing Har Hamor 17 also hold that it is rabbinic.</ref> | ||

# It is permitted to stipulate that the lender will benefit from the borrower's property if they stipulate that he will pay a fair price or deduct that amount he benefited from the loan that the lender will have to repay. This is permitted since the lender will never be taking interest, rather he is deducting the benefit before he collects all of the capital.<ref>Tur and Shulchan Aruch Y.D. 174:5. See Taz 174:5 who poses this as a dispute between the Nemukei Yosef and Tur and in the end he is lenient.</ref> | # It is permitted to stipulate that the lender will benefit from the borrower's property if they stipulate that he will pay a fair price or deduct that amount he benefited from the loan that the lender will have to repay. This is permitted since the lender will never be taking interest, rather he is deducting the benefit before he collects all of the capital.<ref>Tur and Shulchan Aruch Y.D. 174:5. See Taz 174:5 who poses this as a dispute between the Nemukei Yosef and Tur and in the end he is lenient.</ref> | ||

==Taking a Loan only to Benefit the Lender== | |||

# If someone takes a loan only for the benefit of the lender it is permitted for the borrower to let the lender benefit from the borrower's property. For example, if someone doesn't need a house and does a favor to the poor contractor and instructs him to build it and he'll be paid for his expenses. Additionally the contractor can live in the house afterwards for free. That is considered permitted even though the lender is benefiting from the lender's property since it isn't considered a loan at all but a nice deed of the borrower.<ref>Rif responsa 102, Sefer Hatrumot 4:26, Rama 166:3, Brit Yehuda 2:20</ref> | # If someone takes a loan only for the benefit of the lender it is permitted for the borrower to let the lender benefit from the borrower's property. For example, if someone doesn't need a house and does a favor to the poor contractor and instructs him to build it and he'll be paid for his expenses. Additionally the contractor can live in the house afterwards for free. That is considered permitted even though the lender is benefiting from the lender's property since it isn't considered a loan at all but a nice deed of the borrower.<ref>Rif responsa 102, Sefer Hatrumot 4:26, Rama 166:3, Brit Yehuda 2:20</ref> | ||

# Some poskim allow someone who wants to benefit a poor person or a talmid chacham to take a loan for him on interest. If that borrower makes money he needs to pay it entirely to the lender. Since he is doing it as a favor to the lender it isn't interest.<ref>Brit Yehuda 2:20. However, Chelkat Binyamin 166:3 biurim s.v. mi takes another approach based on the Levush that limits the Rama's leniency to where no money of the borrower enters the hands of the lender.</ref> | # Some poskim allow someone who wants to benefit a poor person or a talmid chacham to take a loan for him on interest. If that borrower makes money he needs to pay it entirely to the lender. Since he is doing it as a favor to the lender it isn't interest.<ref>Brit Yehuda 2:20. However, Chelkat Binyamin 166:3 biurim s.v. mi takes another approach based on the Levush that limits the Rama's leniency to where no money of the borrower enters the hands of the lender.</ref> | ||

Revision as of 13:01, 21 June 2020

Lending money on interest is one of the more severe prohibitions in the torah. [1] The lender, the borrower, the guarantor, the witnesses, and even the scribe violate when engaging in an interest-bearing loan. [2]

Basics

- In any case where a person owes a debt to another Jew whether it is because he borrowed money or because he hired him and owes him or because he rented something and didn’t pay yet, it is forbidden to pay more than the actual debt because of the prohibition of taking interest. [3]

- It is prohibited to lend with interest even if the borrower is wealthy and willingly agrees to pay the interest. [4] It is prohibited even in cases where it seems entirely fair such as reimbursing the lender for the interest he was earning while his money was in a non-Jewish bank. [5]

- If neighbors have a good relationship and commonly borrow without being careful to return everything they borrow, then there is no prohibition of interest as the neighbors aren’t borrowing but rather gifting one another. [6]However, if neighbors do not such a relationship then a neighbor who borrows a half a bag of sugar is borrowed only that amount may be returned unless the amount difference is insignificant (about which people don’t care) [7] or if one is unsure how much one borrowed one may return an amount to be sure the loan is repaid. [8]

- Some explain that a key factor in determining if something is considered a loan is whether the item is fungible and normally traded; if it is always traded to be kept that is a sale. Another factor that is used is whether the type of item being lent is similar to the item that is being returned; if they’re dissimilar it is like a sale.[9]

- There is no prohibition of ribbit upon the borrower whenever it is rabbinic ribbit.[10]

Rentals

- It is forbidden to charge interest for a rental.[11]

- If someone got money not as a loan or as a deposit to safegaurd but because of theft or as a debt of rental or wages, even though one can't charge interest, if the one who is obligated to pay wants to pay more he can do so. However, some forbid in all cases.[12]

- There is a dispute if money returned due to an erroneous sale is considered like a loan for the purposes of interest.[13]

Renting Coins

- It is forbidden to rent money to someone else because that is considered Biblical interest.[14]

- There is a minority opinion that one can rent out coins if they stipulate that the renter is exempt from all responsibility including damages from theft, loss, and unexpected circumstances. Ashkenazim rely upon this opinion for rabbinic interest, while Sephardim reject this opinion.[15]

- If the person is planning on using the coins to show them off or to learn from them and isn’t going to be allowed to use them then It is permitted to rent them just like one can rent out any utensil.[16]

- If one is renting coins for show or learning purposes the borrower can’t accept responsibility for the coins if there’s an unexpected circumstance in which the coins are damaged.[17]

Renting Utensils

- It is permitted to rent utensils even if the renter has permission to sell them and replace them.[18] However, one can’t do this with utensils that don’t depreciate with use such as gold or silver utensils.[19]

- It is forbidden to rent out a car, ship, or pot such that they pay rent and if the item breaks the renter must pay for the value of the item at the time of the damage.[20] This is only permitted for items that depreciate with use.[21]

- According to Ashkenazim they may not stipulate that if it breaks then the renter should pay the value of the item when it was originally rented. According to Sephardim this is permitted.[22]

Rentals of Real Estate

- It is permitted to stipulate two prices for rent, one for immediate payment and a higher rate for paying at the end. The reason is that since one is only obligated to pay rent at the end, paying at the beginning at a discount isn’t the real price and is permitted.[23] However, many hold that nowadays this leniency won’t apply since the practice in many places is to have the rent due from the beginning of the month or rental period. If so, it would be forbidden to have a two tiered system for the price of rent.[24]

- Even when or where it is permitted to charge extra for rent it is only permitted when stipulated in advance of the renter beginning to rent. It can not be stipulated once he already began his rental period[25] and certainly not after the rental period has finished.[26]

- When and where it is permitted to have a two tiered rent system it is even permitted when the renter makes this stipulation and payment significantly before he begins the rental.[27]

- If a person is renting a field for work for a certain price and also offers the renter a loan in order to invest in the field itself, they can arrange that the rental price will be higher because of this loan.[28] This is only permitted even after the rental begins before the rental is due.[29]

Worker Salaries

- It is forbidden to add to a worker’s salary for late payment after the worker began and certainly not after the wage is due. That would be considered interest.[30] It is permitted to stipulate immediately before the worker begins to work that if he is paid in advance he would be paid at such a rate and if later at a higher rate.[31] This may not be done well in advance of the worker beginning his work since doing so appears as interest.[32]

- It is permitted to hire someone and pay them in advance for a cheaper price to exempt him from a larger amount of taxes. This only applies when it is likely when the obligation to pay taxes isn't definite because of the king's will, but wouldn't apply to a definite obligation. Hiring them for a definite obligation is forbidden. Also, this only applies when it is stated as such that one is hriing them to exempt oneself from taxes and not that one is hiring them to pay his taxes.[33]

- It is forbidden to hire someone and pay them in advance that they pay off your loan for a larger amount of money. That is interest.[34]

Worker's Salary

- It is forbidden to charge interest for wages of a worker.[35]

- If the employer owes a employee his salary he may not pay more for delaying that payment even if the employee agrees.[36] However, if the employee continues to work for the employer then the payment that the employer makes to his employee can be more than his original salary since the employer may pay him extra for his later work. This was never considered a loan since the work arrangement continued until the final salary due was determined.[37]

Lending an Object

- It is permitted to lend an object such as a tool to one's friend even on condition that if it breaks he will get you a new one even though it is more expensive than the one you lent him.[38]

Stolen Money

- If a person stole money he can return it together with interest since it wasn't a loan.[39]

- For example, if a person invested money with an agent and the agent stole that money for himself. The agent is not obligated to pay any interest upon the money he stole, however, if he does give it then the it is permitted for him to give it and the investor to take it since it wasn't a loan after it was stolen.[40]

Borrowing Someone's Credit Card

- It is permitted for someone to borrow another Jew's credit card to pay for a purchase and repay them the amount spent. Even if the purchaser receives points from the credit card company, that isn't considered interest since it doesn't come from the borrower. Additionally, the borrower may not the purchaser for any interest fees that the purchaser may incur if he pays late.[41] If the borrowing is done in a way that it is assumed that if the borrower won't pay on time he will have to pay the interest fees, such as is common with large amounts, it would be forbidden to lend your credit card.[42]

- It is problematic to borrow someone else's credit card if there are two prices for a certain product, a cheaper price for cash and more expensive for credit. Since there are two prices we can view the cash price as the real price and the credit card price as the convenience price. Once the borrower of the credit card uses the card to buy a product that is worth less than the credit card price and repays the credit card price he is giving interest to the credit card holder.[43]

Partnerships

- It is forbidden for several Jews, two or more, to borrow from a bank or non-Jew with interest such that the non-Jew can collect from any one of them. The reason is that if one of them pays then the others are obligated to repay the one who paid the interest. Thereby the one who paid would be like he lent everyone else with interest and is being repaid with interest.[44] Solutions include: specifying that if one of them pays on behalf of everyone that everyone will repay the one who paid the capital and not interest and the one who paid the bank or non-Jew will lose out on the interest. Another solution is to specify with the bank or non-Jew that every borrower is only obligated up to a specific amount and there's no obligation of one borrower for another.[45]

- If a Jew borrows on behalf of a Jewish partner or Jewish company from a bank or non-Jew with interest and then uses the partner or company's money to repay the loan that is considered interest. This is forbidden since the one signing is considered to have borrowed with interest and when he invests that money with the partner or company he is further lending it to another Jew with interest.[46] However, it is permitted if they originally borrowed in the name of all the partners or the entire company (aside from the other issue of the previous halacha, that one borrower can't be responsible for the entire loan).[47]

- If a Jew borrows on behalf of a Jewish partner or Jewish company for a bank or non-Jew with interest as an investment to the partnership or company and he is working in the partnership or company some poskim are lenient.[48] The halacha is that it is permitted to pay off the interest from the profits that were made with the money that was invested but they should not be taken from the partnership or company if the interest is greater than the profits made from that money.[49]

Rabbinic Prohibition of Interest

- There are several different forms of interest that are prohibited only rabbinically. There are several practical differences if it is only rabbinic. For example, Rabbinic interest was not extended to charities. [50] Additionally, one who receives biblical interest must return it but this does not apply to certain cases of rabbinic interest. [51]

- It is permitted for the yeshiva to give out student loans for tuition with interest since it is only a rabbinic form of interest in that the money was never given to the students to spend and a yeshiva is allowed to taking rabbinic forms of interest.[52]

Involvement with Interest

- Anyone involved in the interest transaction, such as the lender, buyer, witnesses, scribe, or another intermediary is violating the halacha of ribbit.[53]

- It is forbidden to give a gift when returning a loan when if one doesn’t specify that it is because of the loan.[54]

Appearance of Interest

- It is forbidden to couple a fair transaction together with a loan because it appears as interest. For example, a person can't offer an employer an interest free loan and have the employer hire him for a fair wage. Even if the wage is fair and would have been paid even if not for the loan, it is forbidden when they discuss it as part of the same transaction. Furthermore, it is even forbidden if they explicitly state that they are two separate transactions[55] unless they are done at separate occasions.[56]

- It would be permitted if they did the other transaction and then instead of doing a loan, they did a gift and the other party could return the gift but didn't have to.[57]

Legal Subterfuge

- A person asks for a loan of $100 and the lender isn't interested. The lender counter offers him to lend him $100 worth of a commodity and he can sell it for that value and use the money. Then the borrower takes the commodity worth a $100 and offers the lender to buy back the commodity for $90. If the buyer accepts that deal it is forbidden since in effect the borrower borrowed $90 and is obligated to return $100 which is interest.[58]

- This is considered legal subterfuge and even though it is forbidden to arrange, if it is already arranged, according to Sephardim the borrower can repay the full loan. However, according to Ashkenazim the the borrower shouldn't repay the full value of the loan since this is considered rabbinic interest.[59]

- If between the time of the loan and the time of the resale of the commodity to the lender the price of the commodity dropped to $90 then it is permitted to sell the commodity back to the lender.[60]

- If the borrower never took the commodity but everything was transacted orally it is considered rabbinic interest in all circumstances.[61]

- If the borrower stipulated with the lender that they would go through with this entire series of transactions it is certainly interest.[62]

- There is a dispute if it is permitted if the borrower only sells the commodity back to the lender at another time.[63]

Renting a Field to a Borrower

- A person borrowed money and as a collateral gave the lender a field. Generally, the lender may not make use of that field without certain conditions. The lender then rents out the field to the borrower for a fixed rate. That is considered legal subterfuge to charge a borrower interest on his loan and is forbidden.[64]

- If the entire series of transactions were stipulated from the beginning it is certainly forbidden.[65]

- If the field as a collateral was used by the lender and for that use a deduction was made to the loan for each year until the entire loan would be paid off, then if there is someone else in between the borrower and lender it is permitted. That is, if the lender rents out the field to someone else and that person then lends it to the borrower it is permitted.[66]

- It is permitted to sell a field to someone and then rent it from them.[67]

Late Fees

Loans

- It is forbidden to charge or pay a late fee for a payment that is due. Having such a fee is a subterfuge of interest.[68] It is forbidden even on a one time basis and all the more if the late fee is recurring.[69]

- It is equally forbidden if it is a loan with a collateral.[70]

- It is permitted to pay a late fee with a commodity and not cash. That doesn't have the appearance of paying interest.[71]

Gifts

- If someone agrees to give a complete gift and stipulates that if he doesn't give it at a certain date then he will add another gift that is permitted. However, once he completed his initial offer and is obligated to fulfill it, it is forbidden to then stipulate that if he doesn't fulfill it on time he will add a gift at a later date. This is relevant to dowries as well.[72]

Sales

- It is permitted for a person to stipulate that if he doesn't deliver a product by a certain date he will have to pay a late fee. Even though generally late fees are considered like interest, it is permitted in the case of a sale since it isn't a loan in essence.[73] Nonetheless, it is is only permitted to have a one time late fee. It would be forbidden to stipulate that at every week or any other interval that it isn't delivered there is an increasing late fee. Have such a recurring late fee is interest even with sales.[74]

- Some only permit a late fee with a sale if it is structured such that after the late fee is incurred it can be paid immediately or over a certain period of time. If it is stipulated that the late fee once incurred is not due to be paid until a later date, some say that it is forbidden, while others permit it.[75]

Judging by the Time of Stipulation

- It is considered Biblical ribbit to lend 100 items to get 120 items in return, even if at the time of the return those 120 items afterwards are the same price as the 100 items were at the time of the original loan.[76]

- It is considered rabbinic ribbit to lend 100 items to get 100 items in return even if at the time of the return those 100 items are worth more than the price of the 100 items were originally.[77]

Land or Documents

- Ribbit applies to lending land in order to receive more in return or the same land together with something else in return. This is considered Biblical ribbit.[78]

- Ribbit applies to money given in a document.[79]

Mitzvot

- Regarding leniencies for taking interest for a Mitzvah see Corporations_and_Partnerships#Non-Profits

Ribbit for Pikuach Nefesh

- It is permitted to borrow from a Jew with interest in order to save someone’s life. That is only if borrowing from a non-Jew with interest isn’t an option that would allow saving the person’s life. [80] The lender is doing wrong by lending with interest but nonetheless one doesn’t need to worry about causing him to sin if one is trying to save someone’s life.[81]

Mechila in Advance

- It is forbidden to take a loan in order to pay back interest as a gift even though it is a willing and intentional gift. [82]

- It is ineffective and forbidden to arrange in advance that someone will pay you interest and then forgive the interest so that it shouldn’t need to be returned.[83]

- Regarding Mechila after the fact see Returning Interest That Was Wrongly Collected#Mechila After the Fact

Matana Al Menat Lehachzir

- If the borrower gives the lender a temporary gift that will later be returned in addition to the capital that is considered ribbit.[84]

Taking Interest Temporarily

- It is forbidden to take interest even if one will return it afterwards. Some say that this is only a rabbinic prohibition.[85]

- It is permitted to stipulate that the lender will benefit from the borrower's property if they stipulate that he will pay a fair price or deduct that amount he benefited from the loan that the lender will have to repay. This is permitted since the lender will never be taking interest, rather he is deducting the benefit before he collects all of the capital.[86]

Taking a Loan only to Benefit the Lender

- If someone takes a loan only for the benefit of the lender it is permitted for the borrower to let the lender benefit from the borrower's property. For example, if someone doesn't need a house and does a favor to the poor contractor and instructs him to build it and he'll be paid for his expenses. Additionally the contractor can live in the house afterwards for free. That is considered permitted even though the lender is benefiting from the lender's property since it isn't considered a loan at all but a nice deed of the borrower.[87]

- Some poskim allow someone who wants to benefit a poor person or a talmid chacham to take a loan for him on interest. If that borrower makes money he needs to pay it entirely to the lender. Since he is doing it as a favor to the lender it isn't interest.[88]

Sources

- ↑ The Gemara BM 71a says that one who lends with interest becomes poor and never recovers. The Rambam Hilchot Malveh Viloveh 4:2 delineates six biblical prohibitions which could potentially be violated in any particular loan transaction. Ramban Sefer Hamitzvot Shoresh 6 adds a 7th.

- ↑ Mishna Bava Metzia 75b. Shulchan Aruch Y.D. 160:1

- ↑ Shulchan Aruch Y.D. 176:6, Rama Y.D. 161:1, The gemara Bava Metsia 63b explains that as long as one is paying extra to be able to hold the money for longer, it would be a violation of this prohibition.

- ↑ Shulchan Aruch YD 160:1,4.

- ↑ Iggerot Moshe YD 3:93

- ↑ The Weekly Halachah Discussion (vol 2, pg 348) quoting The Laws of Interest (pg 35)

- ↑ The Weekly Halachah Discussion (vol 2, pg 348) quoting Brit Yehuda (Siman 17 note 6)

- ↑ The Weekly Halachah Discussion (vol 2, pg 348) quoting Sh”t Minchat Yitzchak 9:88

- ↑ Biurim in Chelkat Binyamin 161:1 s.v. dvar wrote that there’s a dispute between the Chavot Daat 161:1 and Mekor Mayim Chayim 161:1 why a loan of slaves isn’t loan but a sale. Chavot Daat explains that since each slave is unique and needs a significant evaluation it is considered a sale when you trade one for two later. His premise is that there’s no prohibition of a loan of one item for another like apples for oranges. However, the Mekor Mayim Chaim explains that since a person doesn’t give a slave to be loaned out or traded (lhotzah) but rather to be used it isn’t considered or termed a loan but a sale.

- ↑ Nemukei Yosef b”m 39b s.v. garsinan, Ritva there, Darkei Moshe 160:2, Rama 160:1

- ↑ Teshuvot Maimoniyot 15 records the opinion of Rabbi Eliezer Mtuch that interest is permitted for a rental. His proof is Macot 3a. However, the Bet Yosef 160:21 disagrees with this opinion.

- ↑ Brit Yehuda 2:17. He explains that Rabbi Eliezer Mtuch holds that there is no prohibition of interest when it was a case of a rental or wage. The Bet Yosef end of 160 rejects this opinion as does the Shach. However, the Bach 161 accepts it as a legitimate opinion. The Maharashdam YD 222 cited by Brit Yehuda claims that there's only a dispute if the one who deserves the rent or wage charges the interest but if the one who has the money decides to give extra that is permitted. Masat Binyamin 37 agrees. Brit Yehuda follows that opinion.

- ↑ Chatom Sofer YD 85 and Maharam Shik YD 161 dispute whether money that was taken because of a sale and then the sale falls through whether it is like a loan and it is permitted to pay interest or not. Maharshag 1:4 argues with the Maharam Shik.

- ↑ Rama Y.D. 176:1

- ↑ Rama Y.D. 176:1 accepts the Trumat Hadeshen 302, while in 177:6 he only uses it for rabbinic interest. Shach there opines that the Trumat Hadeshen is even relevant to Biblical cases. Gra 176:2 completely rejects the Trumat Hadeshen. Bet Yosef 176:1 writes that the Trumat Hadeshen doesn’t actually allow it in practice.

- ↑ Tosefta, Tosfot Bava Metsia 69b, Shulchan Aruch Y.D. 176:1

- ↑ Rama Y.D. 176:1

- ↑ Tur and Shulchan Aruch Y.D. 176:2

- ↑ Taz 176:1

- ↑ Shulchan Aruch Y.D. 176:3

- ↑ Rama 176:3

- ↑ Shulchan Aruch and Rama 176:4. The Rambam Malveh Vloveh 8:13 holds that it is permitted to stipulate that the renter will pay the original value of the rented item if it breaks since if it is still around it can be returned as such even if it is worth less due to ware or market fluctuation. Bet Yosef 176:4 cites that the Rashba 69b, Ran 69b, and Mordechai b”m 5:330 agree with the Rambam. On the other hand, the Tur 176:4 holds that doing so is forbidden since the obligation of paying back the original value of the item indicates that it was like a loan and the rent was interest. Rabbenu Yerucham 1:27b agrees and thinks that it is only rabbinic interest, while Ramban b”m 70a s.v. ha damrinan is similarly strict but isn’t sure if it is rabbinic or Biblical interest.

- ↑ Gemara Bava Metsia 65a, Tur and Shulchan Aruch Y.D. 176:6

- ↑ Torat Ribbit 14:7 writes that if in a certain place it is assumed that rent is due at the beginning of the rental and not the end, the Chachmat Adam 136:10 forbids offering two prices for rent. His reason is that once the rent is due immediately it is considered a sale and offering a more expensive price later is forbidden. He also quotes that the Machaneh Efraim 31 writes that it is permitted since essentially it is due at the end but the practice is just to have a condition to pay it up front it is no different than in the days of the gemara. Torat Ribbit himself adds a leniency if it is clear that the price for the payment at the end is the fair market price and the earlier price is a discount that it could be permitted based on the Chachmat Adam 139:5.

- ↑ Talmid Harashba 65a, Bet Yosef 176:6, Darkei Moshe 176:3, Rama 176:6. Bet Yosef has a doubt whether this constitutes Biblical or rabbinic interest.

- ↑ Shulchan Aruch Y.D. 176:6. Taz 176:8 ventures that this is Biblical interest even according to the Bet Yosef since the obligation to pay after the rental period is halachically considered a loan. Shach in Nekudat Hakesef 176:3 disagrees and thinks that the Bet Yosef’s unresolved quandary is still relevant since the obligation was generated by a rental. Chelkat Binyamin 176:67 cites both the Shach and Taz. He adds that there’s an additional reason to assume it is rabbinic; according to the Rambam (cited in 166:2) all interest that isn’t obligated from the time of the loan is rabbinic.